3 Dividend ETFs that will help you retire earlier than your friends

Welcome to the +108 subscribers who joined this past week and are now part of 7,071 millionaires, CEO’s and high-performing entrepreneurs who read the #1 financial newsletter on Substack.

If you’re enjoying The Profit Zone, please take a few seconds out of your day to share this newsletter, leave a like, or a comment. It means the world to me and costs you a total of $0. Thank you for the support! It doesn’t go unnoticed.

Milestone

The Profit Zone just crossed 7,000 SUBSCRIBERS!!!

I started this newsletter just over a year ago and never thought we’d hit 7,000 this fast. I just want to take the time to thank you for your continuous support. Creating this content is my passion and I feel honored that I get the opportunity to do it.

Tweet of the Week

Cash Flow University

Join the fastest-growing online financial community where 15 financial experts hold your hand on your journey to building massive cash flow and leaving your 9-5 forever.

With over 40 topics to learn about, there’s something for everyone.

Our members are winning every day, come see for yourself.

An Exchange Traded Fund (ETF) trades on an exchange like a stock, the only difference is that the fund contains multiple (sometimes hundreds or thousands) of stocks. So by purchasing 1 fund, you’re becoming a part owner of every company within that fund. Pretty cool right?

My best description of ETFs is this. Let’s say you’re out for dinner and you order a salad. You might have ordered the one salad, but the salad is made up of many different pieces. There could be tomatoes, onions, cucumbers, olives, chicken, bacon bits, dressing, and carrots within it. A cucumber on its own is just a cucumber. But a cucumber paired with lettuce and dressing and tomatoes and onions make up the entire salad.

Buying an ETF works the same way. Every company within the ETF helps make the fund what it is. Different ETFs invest according to different strategies, so the contents will change from fund to fund, just like you can order different types of salads.

One thing I’ve realized after 7 years of being a dividend investor is that it’s not enough to just own individual stocks. I like owning salads (ETFs) because it gives me the ability to have my hands in a lot of different buckets.

There are ETFs for everything, Artificial intelligence, e-sports, renewable energy, and electric vehicles. There are ETFs that track funds, there are passive funds, active funds, open funds and closed funds.

But today, we’ll be covering my favorite type of fund: The Dividend ETF. Because there’s nothing better than a salad that tastes delicious but also pays you passively ;)

So without further ado…

Here are 3 dividend ETFs that will help you retire earlier than your friends

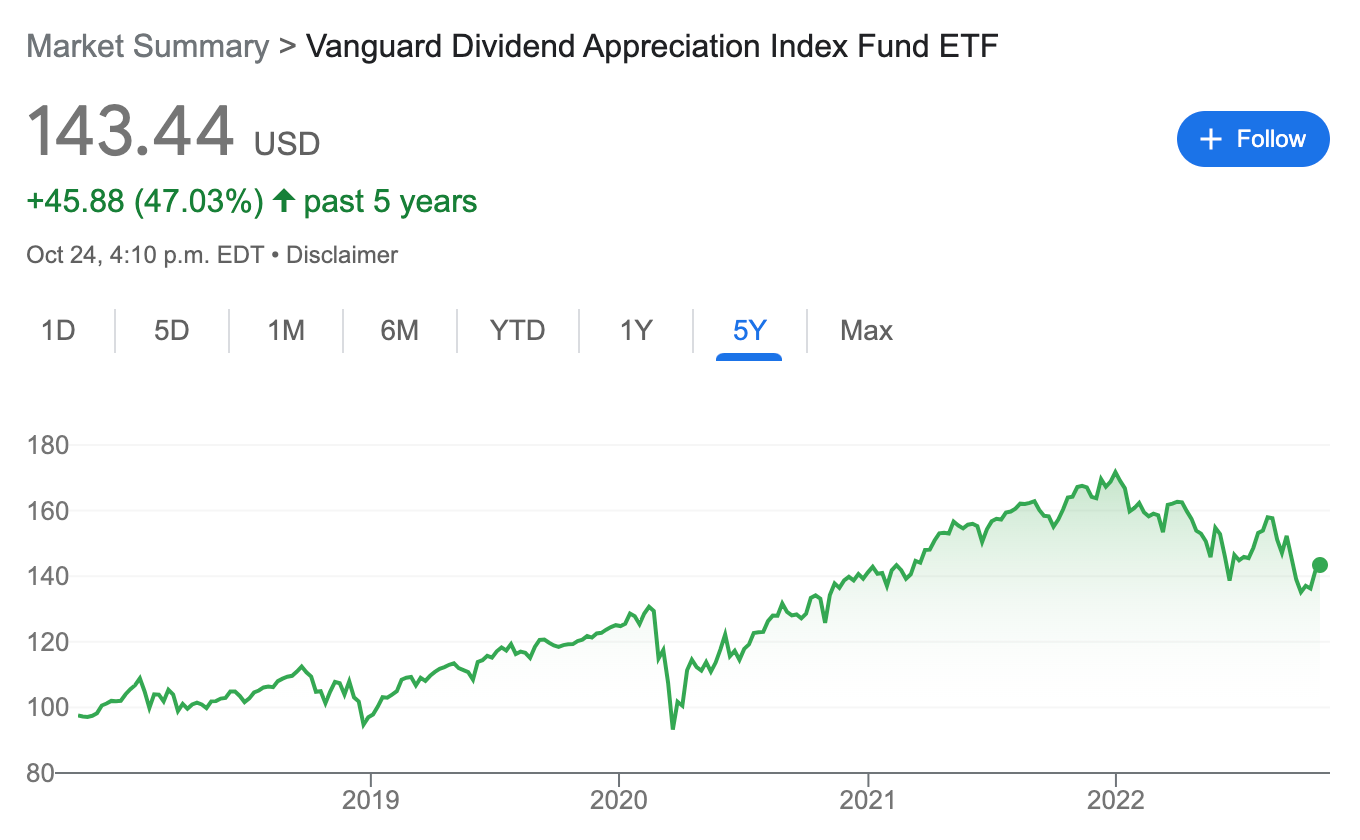

Vanguard Dividend Appreciation Index Fund VIG 0.00%↑

This fund tracks the performance of the S&P 500 U.S. Dividend Growers Index and holds some of the largest dividend payers in the world. Its goal is to track the performance of a benchmark index that measures the investment return of common stocks that have a record of increasing dividends over time. It invests specifically in US-listed companies that have increased their dividend payments for the past 10 years, while excluding the top 25% highest-yielding companies based on annual dividend yields.

Currently with $59 billion in assets under management and an expense ratio of only 0.06%, this ETF provides investors the ability to easily diversify among some of the best dividend stocks money can buy. The fund holds 291 different stocks and is weighted by market cap.

Its top 3 sectors include Finance (13%), Technology (11%), and Consumer Non-Durables (10%).

Top 5 Holdings:

UNH 0.00%↑ (UnitedHealth Group)

JNJ 0.00%↑ (Johnson & Johnson)

MSFT 0.00%↑ (Microsoft)

JPM 0.00%↑ (JP Morgan)

PG 0.00%↑ (Procter & Gamble)

The fund’s Beta is 0.78, which means it’s less risky and volatile than the overall market (Beta = 1) and currently has a dividend yield of 1.93%. Most of the stocks within the fund are large-cap stocks representing 94% of the total fund, which explains the decreased volatility and long-term stability.