5 stocks that have increased dividends for 50+ consecutive years

Welcome to the +21 subscribers who joined this past week and are now part of 6,739 millionaires, CEO’s and high-performing entrepreneurs who read the #1 financial newsletter on Substack.

If you’re enjoying The Profit Zone, please take a few seconds out of your day to share this newsletter, leave a like, or a comment. It means the world to me and costs you a total of $0. Thank you for the support! It doesn’t go unnoticed.

Tweet of the Week

Dividend investors stay winning because they keep getting paid 🏆

Cash Flow University

I’ve had the privieldge of being one of the teachers inside Cash Flow University and I can say with full confidence that I have never seen an online community like this before.

The discord is filled with actionable steps on so many different topics. You can learn about short term rentals, crypto mining, covered calls, cash secured puts, twitter monetization, car rentals, Airbnb and so much more.

It really is a one-stop shop for all things finance.

If you want to stop relying on a salary and take your cashflow to the next level, then you need to be in here.

We’ll hold your hand through the entire process and you can ask questions to financial experts with years of experience.

This is Financial University, minus the $200k in student loans.

Join us and see for yourself.

Dividends are the holy grail of passive income. There are very few passive income streams that require so little work to see growth. Think about it, earning royalties on a book is A LOT of upfront work, but once the work is done you get to reap the benefits for life. Passive income from real estate can be a headache especially if you’re dealing with crappy tenants. I’m not saying these are bad, in fact the opposite, you should have as many streams of income as possible. But what’s cool about dividends is that they can grow on themselves without you having to lift a finger, and that’s powerful, especially if your goal is to get your time back.

But how?

Dividend hikes will give you a raise which you had to do absolutely zero work for

Dividend reinvestment will ensure you get paid more the next time around, which can be done automatically if you turn on the Dividend Reinvestment Plan (DRIP)

With that being said, the one thing we look for as dividend investor are dividend increases. We want our passive income to grow with inflation and dividend hikes help us achieve that, with the exception of this year of course. The goal is capital preservation, we want to keep as much of our money as we possibly can. By investing in dividend stocks, we create cash flow that growth investors don’t have. That cash flow can help offset some of our unrealized losses, and also gives you some extra dry powder to open up a new position or add to an existing one. The possibilities are endless!

So without further ado, here are 5 stocks that have increased dividends for 50+ consecutive years.

These are called Dividend KINGS for a reason 👑

Note: I will not be going into a deep analysis of the following stocks. But at the end of the post, I will show you how I analyze dividend stocks and what to look for so you can do your own research.

Give a man a fish, he’ll eat for a day. Teach a man to fish, he’ll eat for a lifetime.

Dover ($DOV)

A global manufacturer that delivers equipment and components, consumable supplies, software and support services. This beast of a company has been growing their dividend for 66 consecutive years.

Dividend yield: 1.68%.

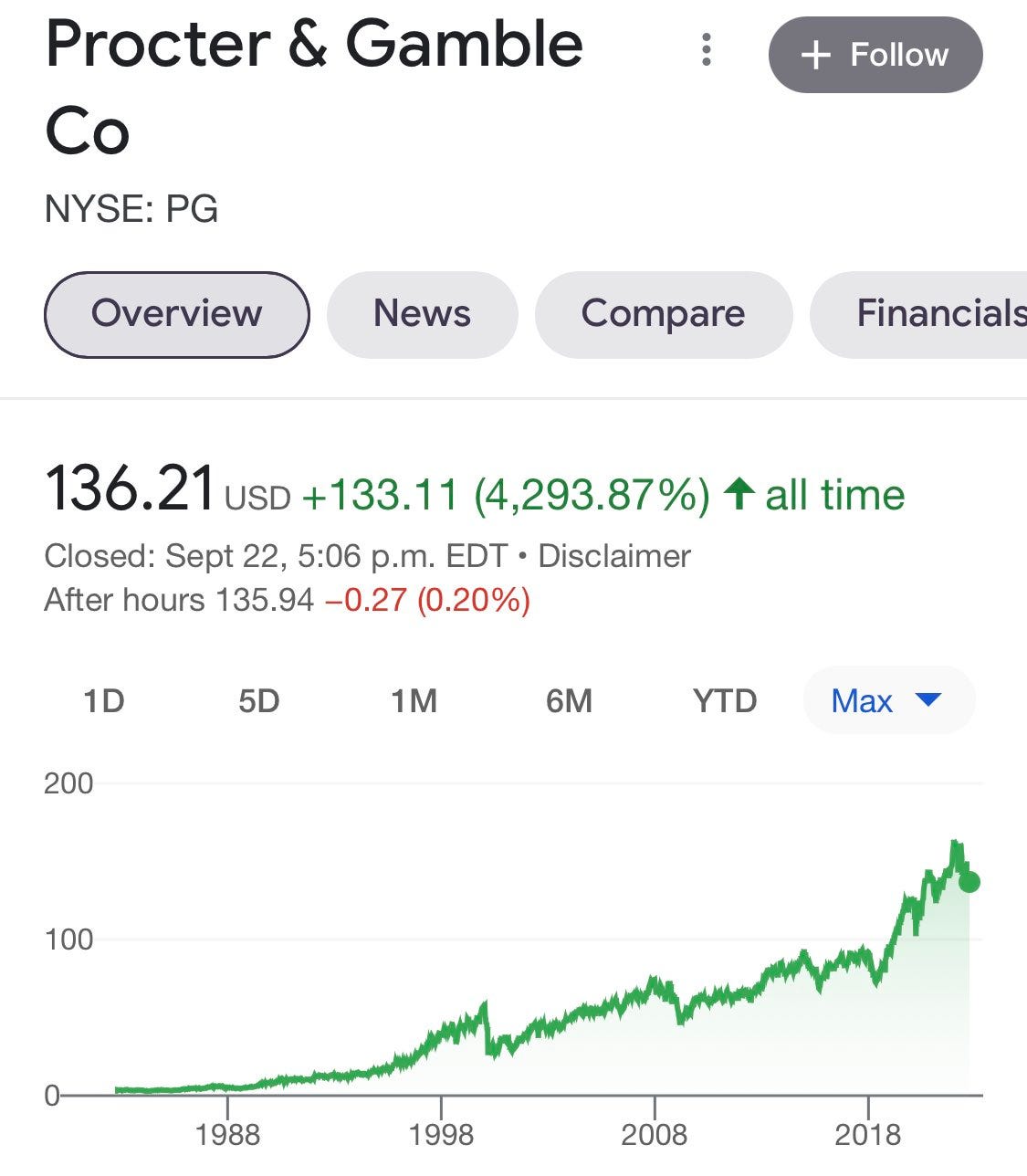

Procter & Gamble ($PG)

An American consumer goods company that specializes in producing personal care and hygiene products. They have also been paying a growing dividend for the last 66 consecutive years.

Dividend yield: 2.68%

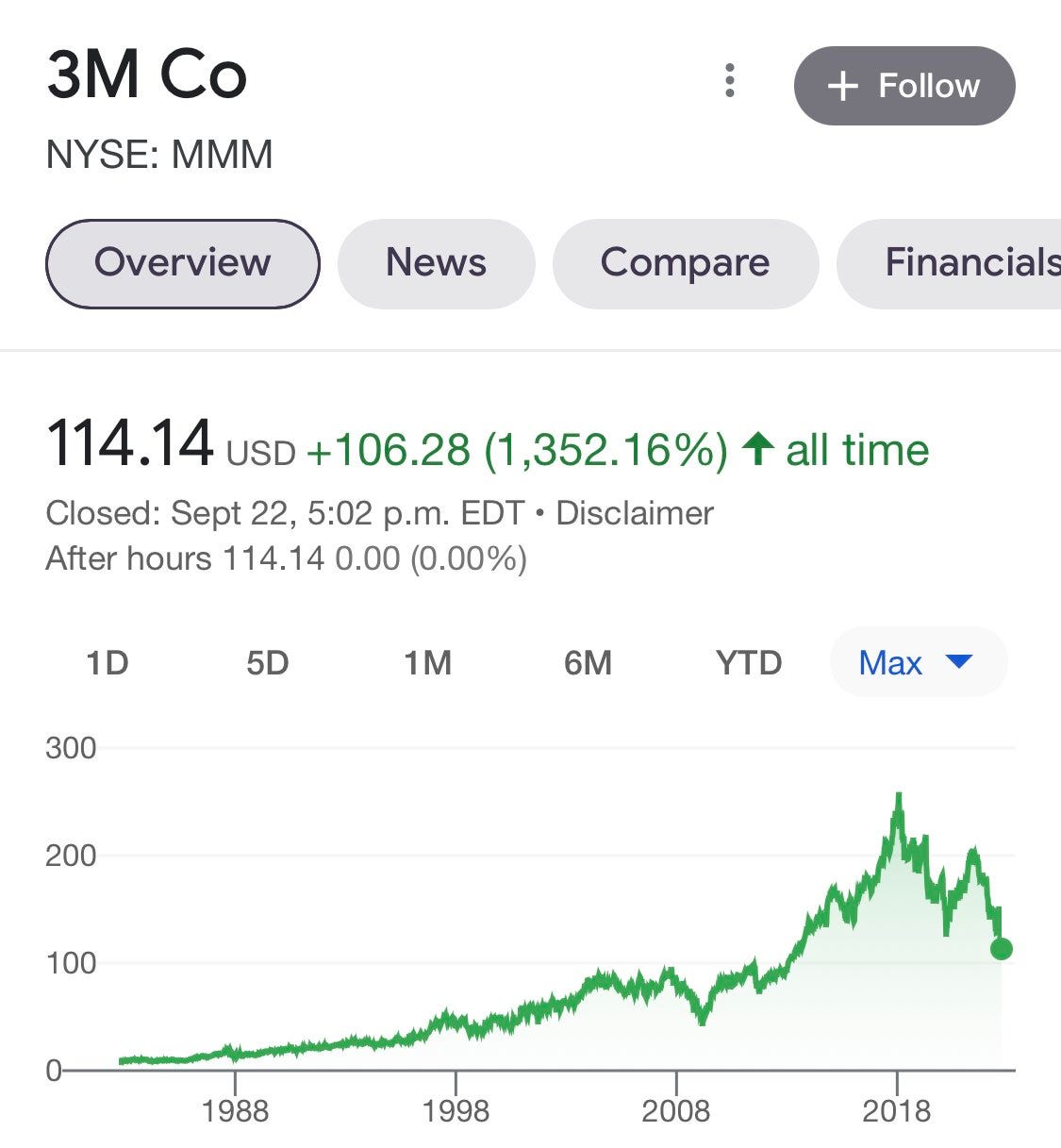

3M ($MMM)

3M manufactures and distributes a wide range of building materials, adhesives, medical and cleaning supplies, and so much more. There’s usually something manufactured by 3M around you at all times.

64 years of consecutive dividend growth.

Dividend yield: 5.22%

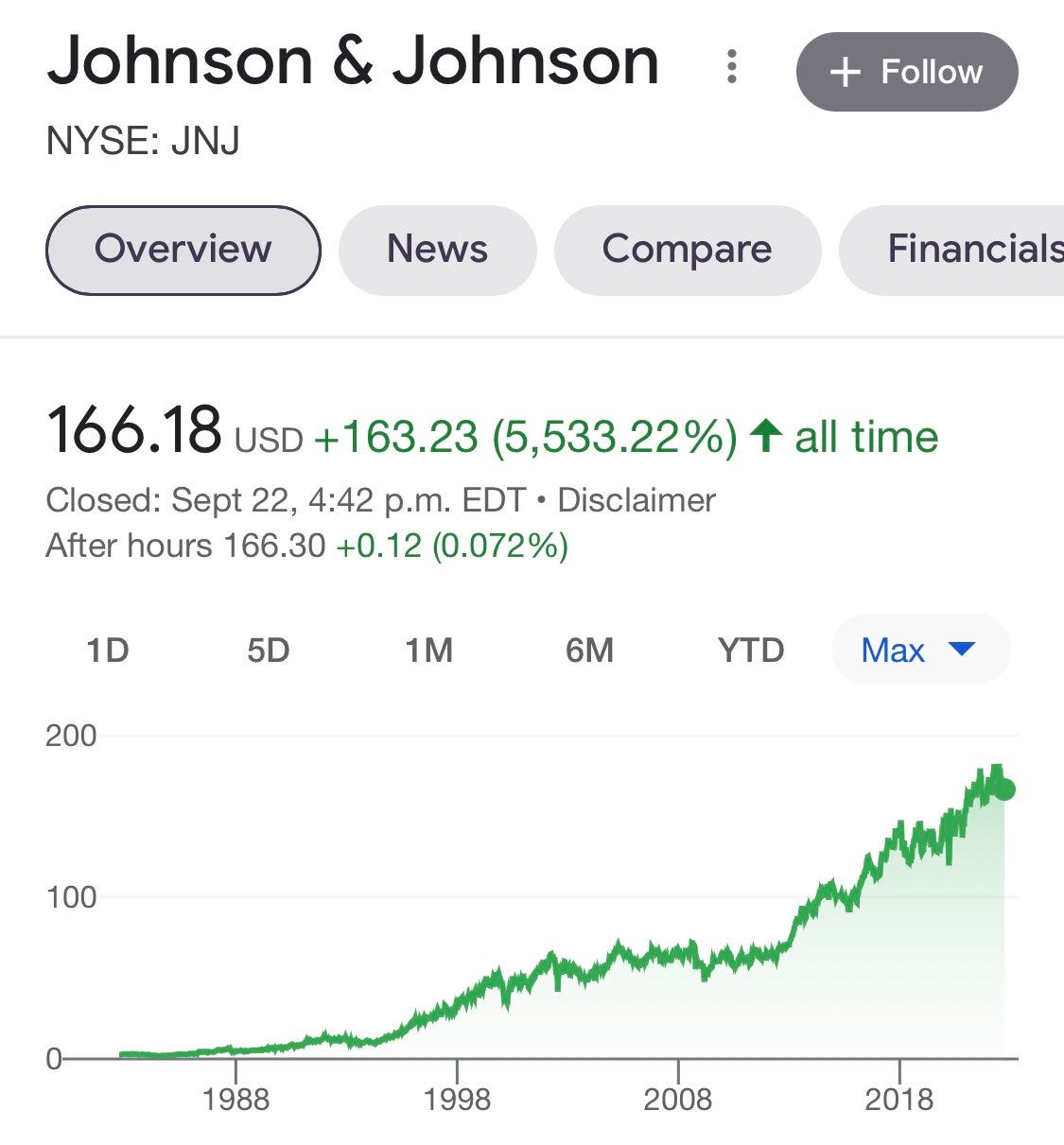

Johnson & Johnson ($JNJ)

A giant that offers a variety of consumer healthcare products, pharmaceuticals and medical devices. This is personally one of my favorite dividend stocks.

They have increased their dividend for the past 60 consecutive years.

Dividend yield: 2.72%

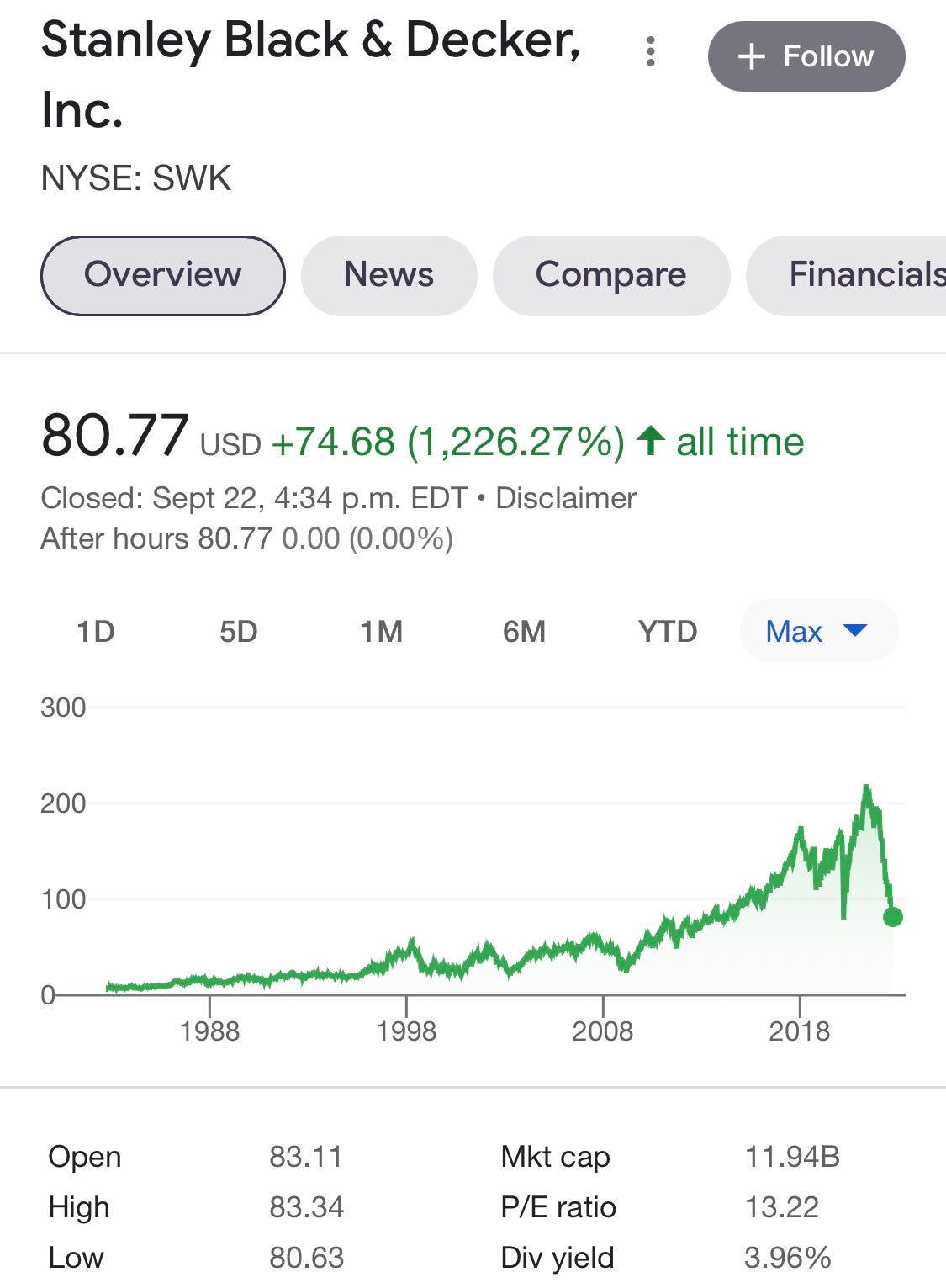

Stanley Black & Decker ($SWK)

An equipment manufacturer that owns brand names like Dewalt, Black + Decker, Craftsman, Troy-Bilt and many more.

This industrial king has increased dividends for the past 54 consecutive years.

Dividend yield: 3.96%

Now that you have the stocks, it’s time for you to do the analysis.

But where do you begin? How do you know if these are actually good companies to add to your portfolio? That’s for you to figure out. But I’ll give you some direction so you have the tools.

Here’s what I’d look for if I was going to analyze a dividend stock 🚀