Capital Appreciation Vs. Cash Flow: which one should you be focusing on?

The benefits and drawbacks of capital gains & cash flow

Welcome to The Profit Zone, where 12,000+ millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on Substack, providing you with weekly insights on the stock market and tips you can’t find anywhere else.

Happy Monday!

Let’s start the week off strong.

The agenda for today:

👉 Indexes continue their run, despite a bad Friday

👉 Sell offs happening in the market

👉 Elon Musk is no longer the richest man on Earth

👉 Cash flow vs. Capital Gains: which one should you be focusing on?

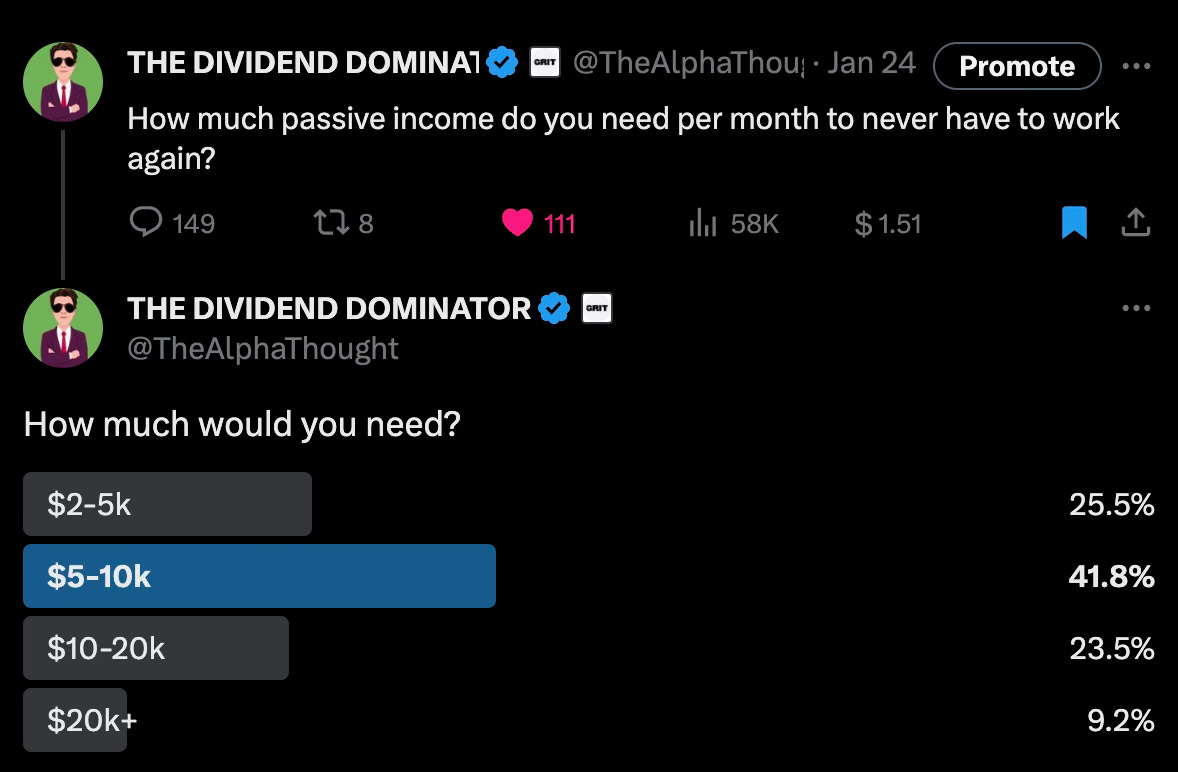

Tweet of the Week

How much passive income do you need to never have to work again?

Advertise with Us

Do you have a business that needs some more exposure?

Want to get more eyes on your products?

Advertise to 12,000+ investors with this newsletter who are hungry for financial content.

Or advertise on our Twitter and Instagram.

Click here to book with us.

Weekly Market Update 🗒️💡

Indexes

The major indexes recorded yet another winning week.

The S&P 500 rose about 1.1%, while the Nasdaq saw gains of 0.9% and the Dow Jones increased by 0.7%.

Despite a winning week, Friday marked the end of a 6 day winning streak for both the S&P 500 and the Nasdaq.

Through to Thursday, the S&P 500 had closed at a record high for 5 straight days, the longest streak we’ve seen since November 2021.

Month to Date performance of the Indexes

The S&P 500 is up 2.8%

The Nasdaq is up 3.4%

The Dow is up 1.3%

On the other hand, the small-cap-focused Russell 2000 has fallen 2% this month.

Sell offs

Sell-offs among some well-known companies post earnings report is what restricted gains this week.

Intel INTC 0.00%↑ fell almost 12% on Friday after releasing their dissapointing Q1 outlook.

Tesla TSLA 0.00%↑ also registered its worst week since October, falling 13.6% after the EV maker published dissapointing earnings and warned of some bumpy roads ahead in 2024.

The New Richest Man in the World

Bernard Arnault, the billionaire chairman and CEO of global luxury goods company LVMH, that includes brands like Louis Vuitton, is now the richest man in the world, dethroning Elon Musk.

As per Forbes Magazine, Arnault and his family's net worth soared to $207.6 billion after a $23.6 billion increase on Friday.

The new list of the top 10 richest people in the world:

Bernard Arnault & Family ($207.6 billion)

Elon Musk ($204.7 billion)

Jeff Bezos ($181.3 billion)

Larry Ellison ($142.2 billion)

Mark Zuckerberg (139.1 billion)

Warren Buffett ($127.2 billion)

Larry Page ($127.1 billion)

Bill Gates ($122.9 billion)

Sergey Brin ($121.7 billion)

Steve Ballmer (118.8 billion).

The Debate: Capital Gains Vs. Cash Flow

When it comes to investing in the stock market, many investors struggle between investing for capital gains vs. investing for cash flow.

In today’s Profit Zone, I’m going to be highlighting the pros and cons of both sides of the equation, as well as giving my thoughts about how to build a solid portfolio that will help you reach your financial goals.

Let’s go back to the basics.

What are Capital Gains?

A capital gain occurs when you sell an asset for more than what you initially paid to acquire that asset.

This applies to assets such as stocks and real estate.

For example: If you paid $10,000 to buy Apple Stock AAPL 0.00%↑ , and 2 years later you sold that investment for $25,000, you would have a capital gain of $15,000.

What is Cash Flow?

Cash flow refers to the money you are making on an investment.

Again, this applies to assets such as stocks and real estate.

For example: If you paid $10,000 to acquire shares in Johnson & Johnson JNJ 0.00%↑, who currently has a 2.94% yield, the money you earn on that investment is considered cash flow.

The same goes for real estate when you rent out a property and the tenants pay you rent every month.

This is considered cash flow, whether or not it’s positive cash flowing depends on your expenses (referring to real estate).

How are Capital Gains Taxed?

Investors are required to pay tax on capital gains, and that tax is owed for the tax year during which the investment was sold.

There are different types of capital gains tax depending on how long you own the asset.

An investor who owns an asset for AT LEAST 1 year will owe long term capital gains tax on the profits they earned when selling the asset.

An investor who owns an asset for LESS THAN 1 year will owe short term capital gains tax on the profits they earned when selling the asset.

These are taxed differently.

Short term capital gains tax

The amount owed on short term capital gains is the difference between the cost basis of the asset (what you paid) and the sale price (what you received).

Short term capital gains are taxed at the investors marginal tax rate and these vary in range from 10% to as high as 37%, depending on your annual income.

See below to get an idea of how much you will need to pay in short term capital gains tax as of 2023 depending on your current situation and annual income.

Long term capital gains tax

Many taxpayers pay a higher rate of tax on their active income (income earned by trading your time) than on any long term capital gains.

This provides incentive to hold assets for minimum of a year, to avoid paying more in taxes.

This becomes an issue if you are day trading, as any profits you earn from buying and selling assets are not just taxed, but taxed at a higher rate than if you held them for more than a year.

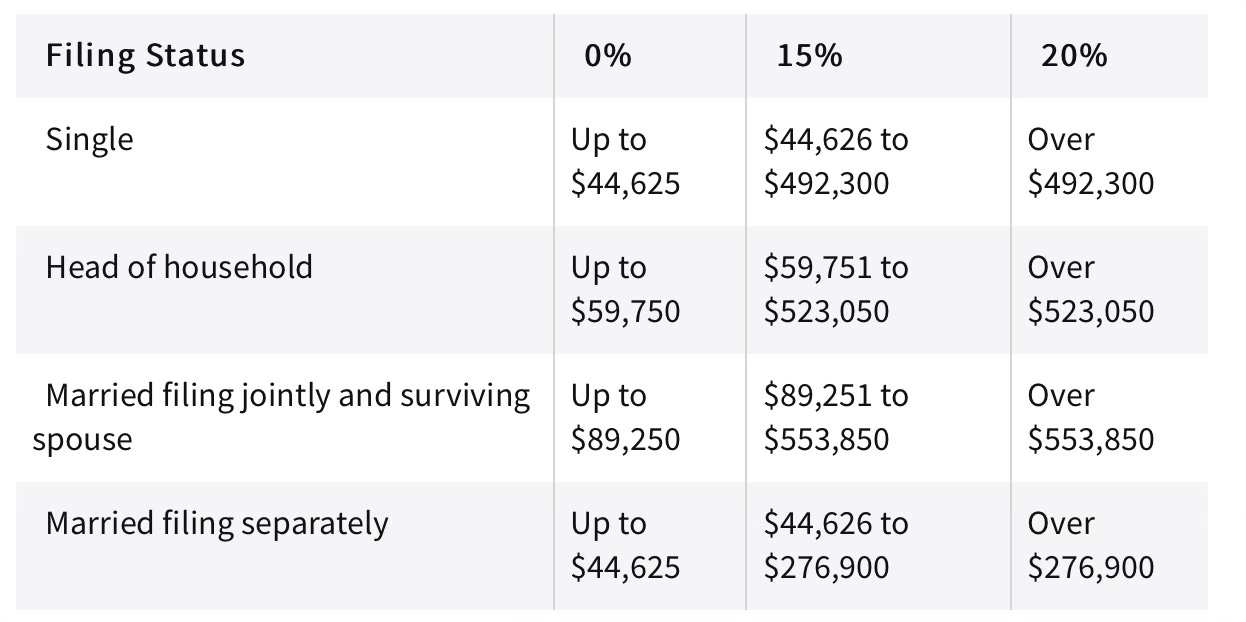

See below for how much you will have to pay in long term capital gains as of 2023.

As you can see, the tax law benefits those investing for the long term (1+ years) and puts you at a disadvantage if trying to buy and sell out of assets for a short period of time.

It’s important to be aware of how much tax you will be paying on your gains depending on your investing strategy.

Ways to decrease your tax burden on gains

Increase your holding period: holding on to investments for more than a year gives you more favourable tax treatments when you decide it’s time to sell.

Use tax sheltered accounts: there are plenty of options for tax sheltered accounts in the US and in Canada, for example IRAs, 401(k)s, TFSA’s, RRSP’s and FHSA’s. With the exception of a few, these are considered tax deferral accounts, meaning you’ll be able to write off your contributions come tax season, but upon withdrawal you may be subject to tax implications. For my Canadian’s, TFSA’s (Tax Free Savings Accounts) are a great way to avoid paying tax on any income or gains earned in the account, however there are contribution limits you need to be aware of.

Tax offsetting: investors can use capital losses as a way to decrease their taxable capital gains. There are limits to what can be carried over into the next period as well as how much you can write off, however understanding how to decrease your tax burden using capital losses is a great way to keep more of your money. I wrote a post on tax loss harvesting that outlines everything, which you can read below.

Donations: investors can donate their appreciated assets to charity and avoid realizing the gains. When a donation occurs, the investor is not subject to taxes on the transaction and instead they receive a receipt for the fair market value of the asset. If you’re feeling generous, this could be an option.

How is cash flow taxed?

Ordinary vs. Qualified Dividends

Dividends are separated into two classes by the IRS.

If you’re going to be dividend investing, you need to understand the difference between an ordinary dividend and a qualified dividend.

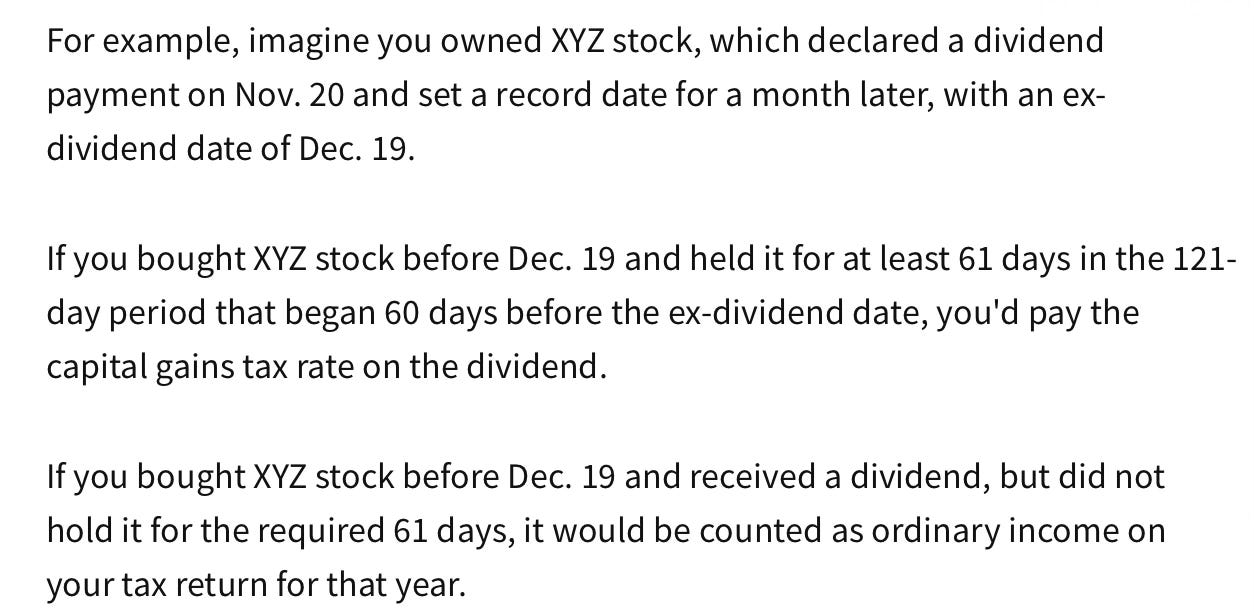

A dividend is considered to be qualified if you have held the stock for more than 60 days in the 121-day period that began 60 days prior to the ex dividend date.

A dividend is considered to be ordinary if you hold it for less than that time.

If you are dividend investing, the chances are you’re buying your stocks for a long period of time so most if not all of your dividends will be considered qualified.

See below for an example:

Taxation of cash flow

The tax rate on qualified dividends is 0% if your taxable income for the year is less than $41,675 for singles and $83,350 for married filers.

If you earn more than $41,675 as a single or $83,350 as a joint, you’ll pay a 15% tax on qualified dividends. If your taxable income for the year exceeds $459,750 for a single and $517,200 for a joint, you’ll pay a 20% tax.

This may vary depending on where you live, so make sure you do your own research to determine your tax rate on cash flow.

Exceptions

There are some exceptions to this tax rule.

This includes dividends paid by REITs, MLPs, employee stock options, dividends paid from money market accounts as well as special one time dividends.

Also, dividends associated with hedging, such as short sales, puts and call options will be subject to ordinary taxation and won’t be qualified.

Should you invest for cash flow or capital gains?

My simple answer: chase total return.

Total return is the combination of share appreciation and any cash flow you earn from your investment.

It’s never been a debate of doing one or the other, but how you can minimize your tax burden doing both.

When you have both, you’ll be on the fast track to financial independence.

Personally, I hold the bulk of my dividend stocks in tax sheltered or tax deferral accounts like a TFSA, FHSA and RRSP (P.S. I’m a Canadian investor and these don’t apply to those investing outside of Canada).

I do it this way so that I limit how much tax I’m paying on any income or gains I make inside the account.

I encourage you to read up more about the tax implications you will experience on your investments depending on where you’re investing.

Remember: the rich don’t only get richer because their money is working for them. The rich get richer because they understand the tax laws and how to make them work in their favour.

Tax laws are for everyone, the more you know, the less you’ll pay.

Alex (The Dividend Dominator)

Founder and CEO of Dividend Domination Inc.

Follow me on Twitter, Instagram and LinkedIn

Some resources to help you make more money:

My Website - a one-stop shop for all things dividend investing.

Ca$hing in on Twitter - start building a following on Twitter and learn how to monetize it. Turn Twitter into your own personal cash-flowing asset that will pay you while you sleep.

My Full Stock Portfolio - get access to all of my positions and get updates every time I buy or sell.

Money Mastermind - the “Money Bible”. Myself and 29 other expert creators teamed up to create the most all-inclusive 280-page finance book on the market. Over 100 topics about money including real estate, crypto, budgeting, dividend stocks, online business, and more.

The Complete Investors Accelerator Pack - everything you need to build a dividend portfolio that grows on itself. Learn more about dividend investing, how to analyze dividend stocks, what to do with your dividends and how to build a stream of passive income through the stock market.

TweetHunter - let the software do the tweeting for you. The only scheduler you’ll ever need. This tool makes me money in my sleep. Give it a try for free.

Hipster Budget Guide - having trouble saving money? Learning how to budget is your solution. This book will show you ways to save money you never even thought of. Worth every penny.

I recently commented on an article of the 'Top Dividend Stocks for 2024' by MoneySense, but the prior year's 'total' returns were mediocre (~12%) to abysmal (~2%). I endorse your view that 'total' return should be the focus and not just cashflow (i.e., income/dividends/yield), and my approach providing from 20% to 39% annually. I prefer dividend stocks with sustained above-average capital appreciation (> 10%) and reasonable dividend growths over the prior year and years. I am willing to accept lower dividend yields for higher capital appreciation, kinda like the forest is growing faster and producing more fruit! With Einstein's 8th Wonder of the World, "compounding", it doesn't take long to start reaping the greater benefits!