Emerging markets are your key to higher ROIs…

Are you ready to become the “treasure-hunter” investor?

Welcome to the +51 subscribers who joined this past week and are now part of 11,414 millionaires, CEO’s and high-performing entrepreneurs who read the #1 financial newsletter on Substack.

If you want the benefits of being a premium subscriber, consider joining on a 14-day free trial.

Get added BONUSES like:

deep dives into high-quality assets

portfolio management tips you won’t learn on YouTube

mistakes I’ve made that you want to avoid at all costs

Test the waters before making a commitment.

Click below to unlock premium content.

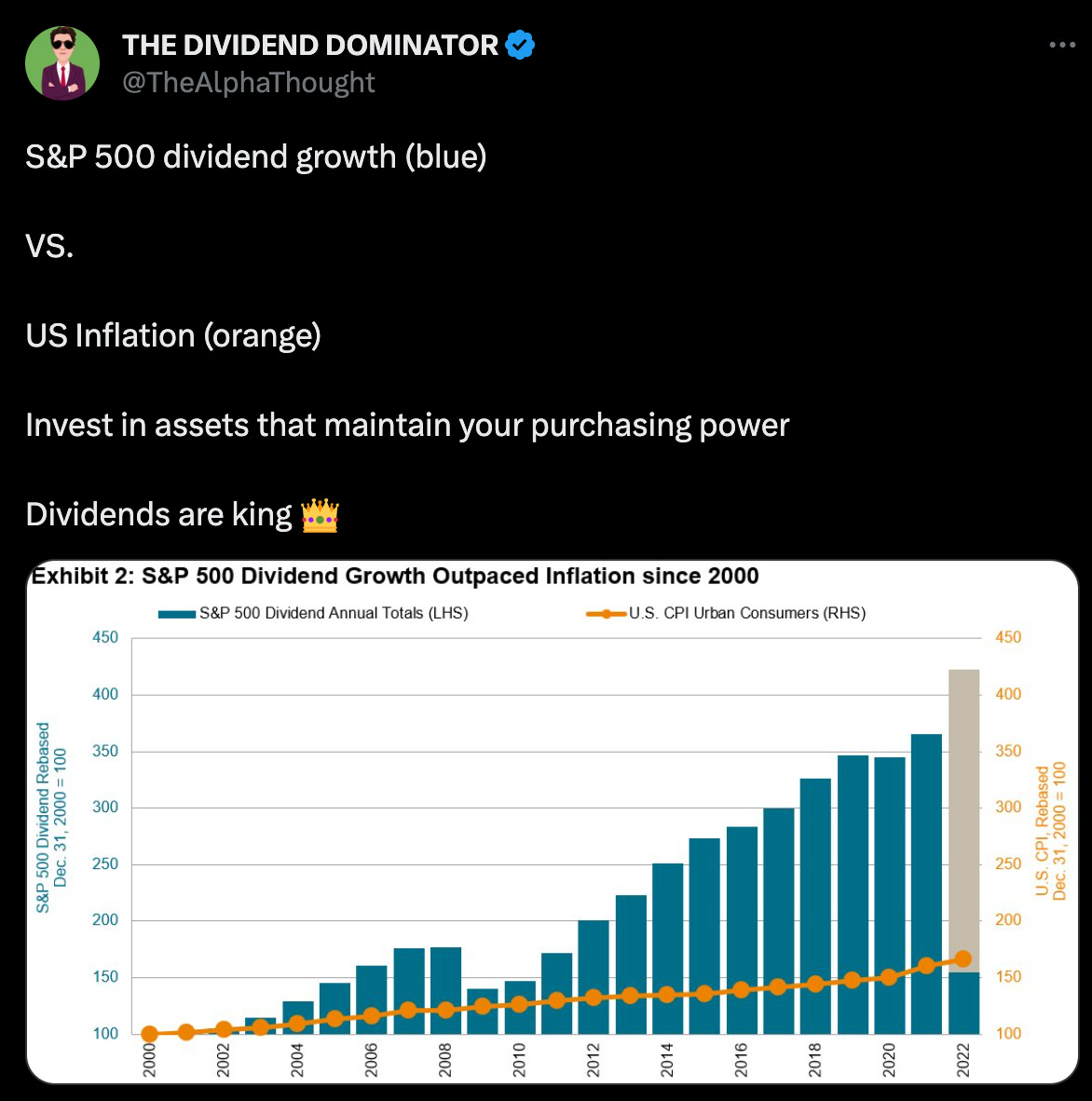

Tweet of the Week

Weekly Market Update 🗒️💡

BREAKING NEWS:

The Dow Jones has officially entered bull market territory, rising more than 20% since November 2022 lows.

This is your reminder to stay invested.

Although the Dow began its bull run later than the S&P and the Nasdaq, blue-chip stocks are now starting to look more attractive to investors who are becoming more comfortable with investing in reliable and sustainable companies.

So what makes this index so attractive?

A forward P/E of 17x, which is trading at a more attractive multiple than what you would see in the S&P (19x) and the Nasdaq (25x).

Speaking of the Dow Jones, I wrote a post on the Dogs of The Dow Strategy which you can read here.

A strategy whereby an investor buys the top 10 highest-yielding stocks of the Dow Jones every year. The premise is that by purchasing the highest-yielding stocks, you’re investing at a period where the stock price has fallen the most.

If you’re not familiar with dividend yields, the stock price and dividend $ amount are correlated. If the stock price falls and the dividend remains the same, the dividend yield (%) rises. The opposite is also true.

Therefore you’re getting a high-yielding company that has room for share price growth.

Here are the top 10 highest yielding stock in the Dow right now:

1. Verizon Communications (VZ)

2. Walgreens Boots Alliance (WBA)

3. 3M Company (MMM)

4. Dow Inc. (DOW)

5. International Business Machines (IBM)

6. Chevron (CVX)

7. Amgen (AMGN)

8. Cisco Systems (CSCO)

9. Goldman Sachs (GS)

10. Johnson & Johnson (JNJ)

Learn more about the Dogs of the Dow strategy here.

Grab your hat and buckle up…

You and I are about to go on a wild ride through the world of emerging markets.

Picture yourself being a treasure hunter, on a quest to uncover the mystery of emerging markets and strike it rich!

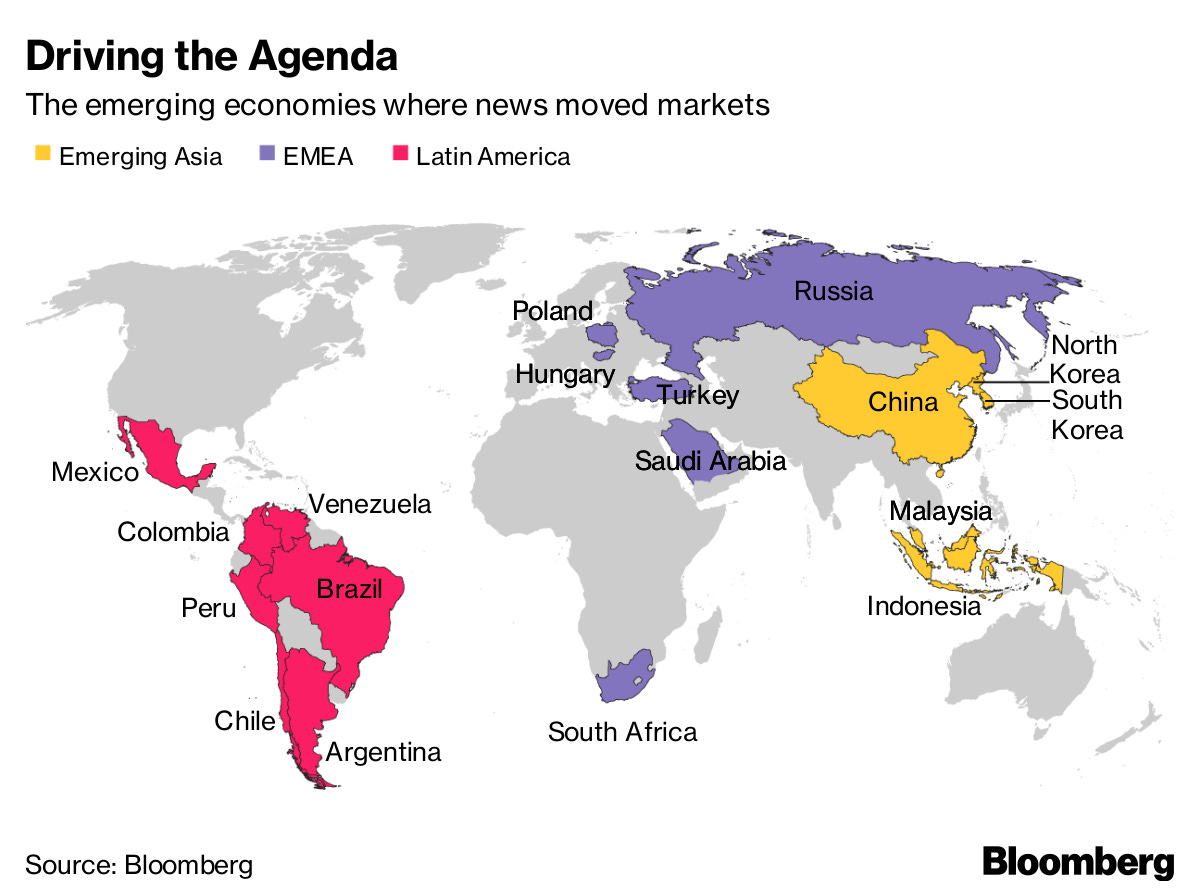

But what are emerging markets?

Emerging markets are like unexplored territories that are waiting for you to discover them. It's like stumbling upon a secret island that's brimming with untold treasures.

And guess what? You have the chance to discover and snatch all these treasures for yourself.

Emerging markets are like a roller coaster filled with a thrilling mix of risks and rewards…

Let’s talk about the main rewards, which are:

High growth potential.

Emerging markets hold the key to higher returns, surpassing the growth potential of more developed markets.

This investment will age like fine wine, bringing you thousands of dollars for every dollar invested.

At least that’s the idea.

Diversification.

Investing in emerging markets adds a powerful weapon to your portfolio: diversification.

By spreading your funds across different regions and sectors, you become a risk-savvy investor, shielding yourself from losing all your money on a stock nosedive.

Undervalued assets.

Imagine finding assets that are bursting with untapped growth potential, yet priced lower than their actual worth.

It's your once-in-a-lifetime opportunity to snatch these undervalued treasures at irresistible prices…

So you can then watch your investments flourish as their true value gets recognized.

Consumer-driven sectors.

Emerging markets are buzzing with a thriving middle class, eager to replace paychecks with growing cash flow from investments.

From must-have consumer goods to retail therapy, and cutting-edge telecommunications to innovative financial services…

Investing in these sectors may very well help you replace your paycheck with passive income down the road.

Infrastructure development.

Emerging markets are hungry for progress and need significant investment in infrastructure to fuel their economic growth.

Think about the colossal possibilities in construction, energy, transportation, and utilities.

By investing in this infrastructure evolution, you not only contribute to their development but may also secure yourself some sweet profits too.

It's a win-win scenario where their progress and your profit go hand in hand.

But hold on tight, you fearless treasure hunter, because there are challenges along the way that might leave you with no dime in your pockets…