Holiday Special: a deep dive into my favourite dividend growth stock

Welcome to the +255 subscribers who joined this past week and are now part of 7,942 millionaires, CEO’s and high-performing entrepreneurs who read the #1 financial newsletter on Substack.

We just set another record week of growth in The Profit Zone!!! I can’t thank you guys enough for your support.

If you’re not a subscriber to The Profit Zone, you’re missing out.

Click below to join and make sure every issue is sent right to your inbox on Monday mornings.

Cash Flow University

CFU is growing every single day and our members are constantly winning. As one of the teachers inside, I’m still blown away by the quality of the information.

I can say with full confidence this community will teach you more than any college degree ever will.

This is your last chance to join CFU at $30.

Because on January 1st the price goes up to $49.

But if you sign up now, you will be locked in at $30 forever.

Click the button below, just promise me you’ll unsubscribe when you leave your 9-5.

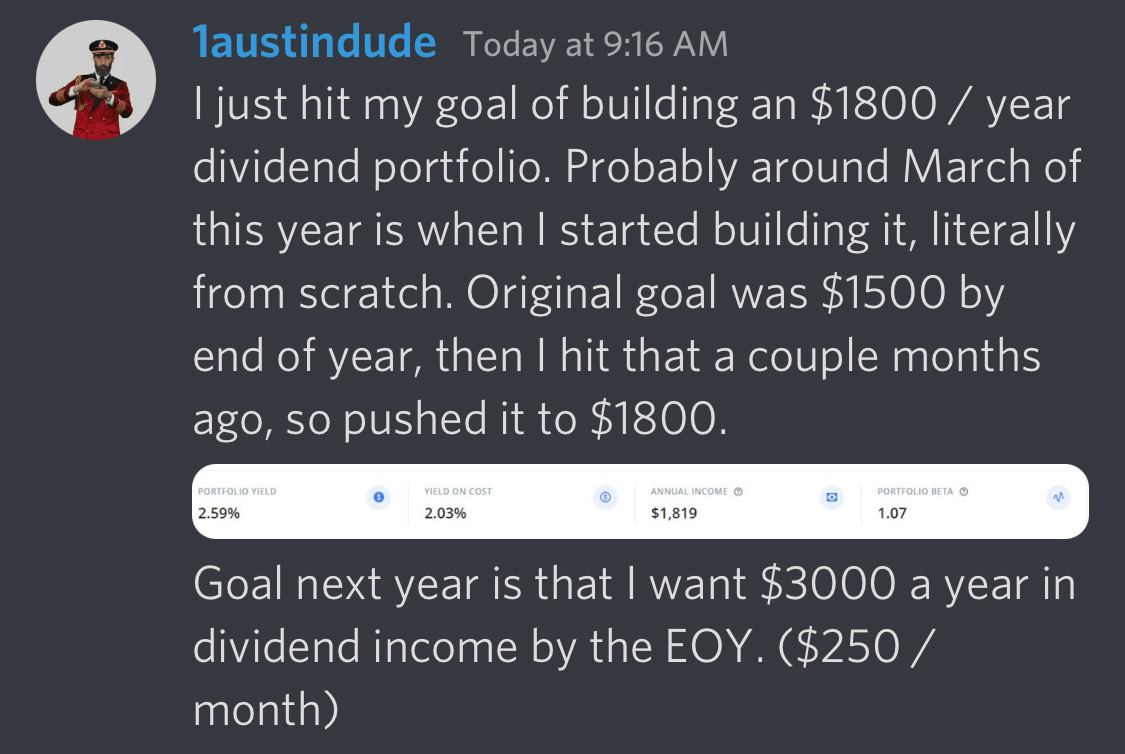

Tweet of the Week

Home Depot

One of my favorite dividend growth stocks of all time is Home Depot HD 0.00%↑. A home retailer that sells a variety of different building materials, machinery, and garden products as well as pretty much anything you would need to fix something up or build something from scratch. Not only do they sell products, but part of their business model is offering installation services for things like cabinets, televisions, countertops, furnaces, flooring and much more. Finally, you can even rent tools from Home Depot if you only need them for a short period of time. A one-stop shop for all things building!

Before we dig into this company’s financial and ratio analysis, let’s go over why I like this business so much.

The reason is simple. During COVID, a period where many people had lost their jobs, made less money and were forced to stay inside, construction (especially DIY - do it yourself) skyrocketed. Even now, while interest rates continue to rise and money becomes more expensive to borrow, construction has slowed of course, but not entirely.

The point is that there’s a need for the progression of infrastructure or home improvement. Homeowners want to continue increasing the value of their homes through value-add projects, and developers want to continue the construction of highly dense buildings so they can turn a profit.

(I live in the city so this story may be different depending on where you live)

As someone who works in the Real Estate industry, I’ve seen it firsthand. The increased cost of materials had an effect on construction, but it was short-lived. While all these people continue to build and grow large cities as well as develop smaller suburban cities, they’ll need a place to get their tools and materials. That place is a retailer like Home Depot.

Here’s the trick to long-term wealth: invest in companies that make/sell products people need/use every single day.

Ratio Analysis

As of today, Home Depot has a market cap of $323B and currently trading at a 19 P/E. The current share price is $315 which is ~25% off from its 52-week high, a nice little discount if you ask me.

The company’s current ratio is 1.39, which means that its current assets can cover its current liabilities 1.39x over in the event that it needs to pay its short-term obligations right away. This is a good sign while entering a possible recession.

Home Depot’s return on assets (ROA) currently sits at 22.7% which is a strong number given its large amount of inventory. Their return on investment (ROI) is also strong at 44%, which is a healthy sign for long-term growth.

Finally, their net profit margin continues to rise year over year and is currently sitting at 10.87%, as seen below. When margins are growing, that’s a sign that demand continues to remain while the company finds ways to cut operating costs.

*the rest of this post is for paying subscribers only. If you’d like to read it, consider becoming a paid subscriber below. If you are a paying subscriber, please ignore this message*

As for revenue, here are the stats from the past few years: