how to find your optimal asset allocation + 1 bank stock I can't stop buying

Welcome to the +82 subscribers who joined this past week and are now part of 6,637 millionaires, CEO’s and high-performing entrepreneurs who read the #1 financial newsletter on Substack.

If you’re enjoying The Profit Zone, please take a few seconds out of your day to share this newsletter, leave a like, or a comment.

Tweet of the Week

Finding your optimal asset allocation

Ever heard of the saying “don’t put all of your eggs in one basket?”

Today I’m going to be showing you how to spread your eggs into multiple baskets, the correct way.

There are so many ways to diversify. A couple that come to mind include diversifying by:

Market cap (micro, small, mid, large)

Region (international, domestic)

Market (emerging, developed)

Asset type (bonds, equities, ETFs, Mutual Funds, Hedge Funds)

Real estate (REITs or physical property)

Knowing how many ways you can diversify means nothing if you’re not diversifying according to your own goals, and every investor’s goals are different.

Your optimal allocation is one that gives you the *realistic* return you’re looking for while also allowing you to sleep at night.

You can’t expect to have returns of 150% every year and also get a good night’s sleep, because you will undoubtedly be stressed 24 hours a day if that’s your goal.

You could have peace of mind by investing in only bonds but that may not give you the returns you’re looking for.

Diversification is about finding balance, and in this issue, I’m going to take you through a few sample portfolio allocations you can use as your own benchmark.

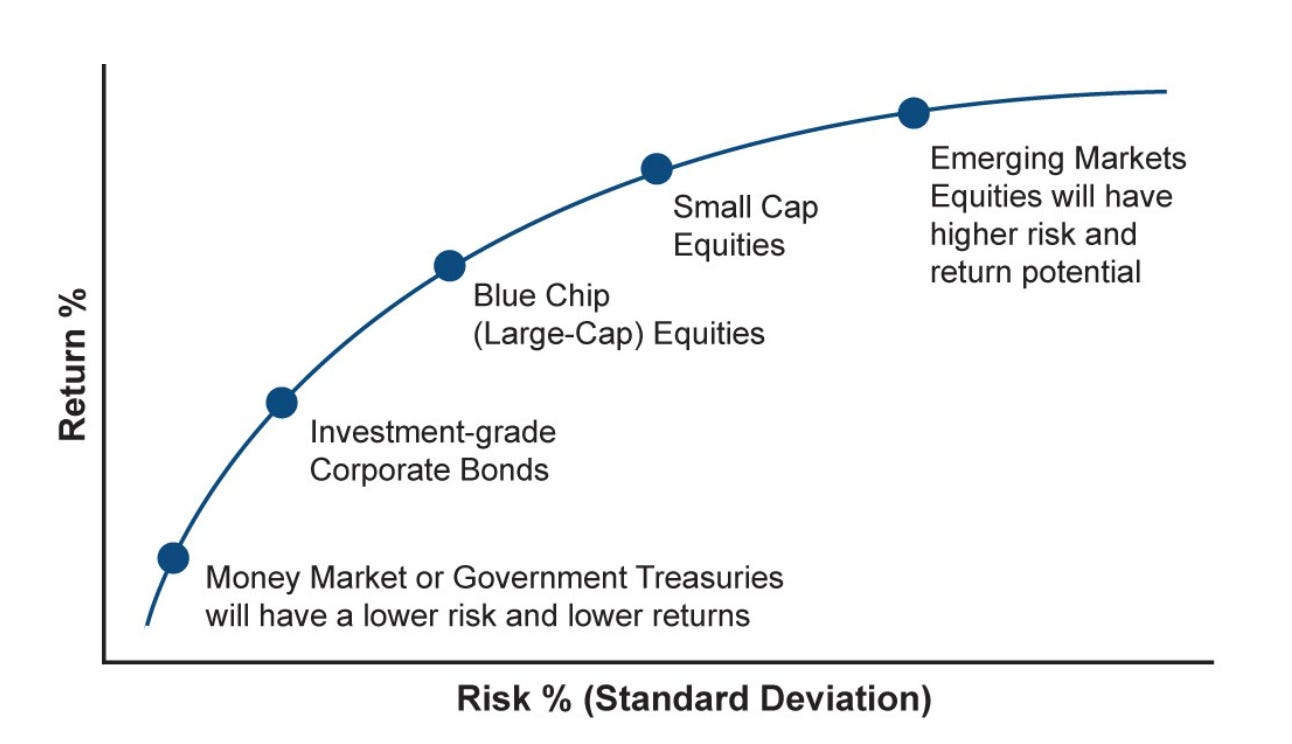

Below is a graph of risk to return so you know where different types of investments stand on the spectrum.

A common rule of thumb is that investors will decrease their exposure to risk as they near retirement in order to retire with the largest sum of money possible. This is also why people like to say dividends are for old people only because dividend stocks are naturally less volatile than a Tesla for example, but truth be told, dividends are NOT only for old people (that’s a story for a different day).

So how do you decide what’s right for you?

That’s a question that depends on your time horizon and your risk tolerance.

Those with longer time horizons and larger amounts of money can invest in higher-risk stocks with more upside because they have the time (and capital) to make up for any massive losses that may occur.

Those with shorter time horizons and smaller amounts of money may choose to invest in lower-risk stocks because they don’t have as much time (or capital) to make up for a massive loss.

You have to be completely transparent with yourself.

If you only have $5,000, splitting it 50/50 between 2 small cap tech stocks may not be the best idea.

If you have $500,000 and want to take $5,000 and go all in on a small cap tech stock, that’s a smarter financial decision than the one above.

If you’re looking to buy a house in the next 5 years, keeping all of your money in stocks may not be the best call.

Everything is relative and everyone’s situation is different. That’s why large investment firms have come up with several example portfolio’s you can imitate to achieve your optimal asset allocation according to your own situation.

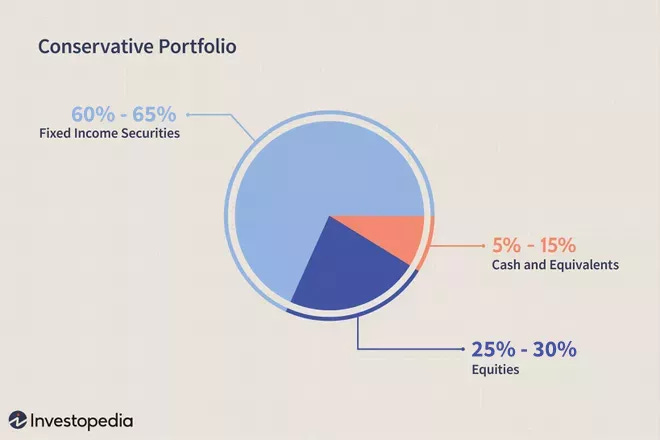

Conservative

Conservative portfolios usually include more fixed income and money market securities, things like bonds and T-Bills/GICs. These are assets that will pay you a fixed amount of money (often guaranteed) but you won’t find high returns like you otherwise would with stocks. These types of portfolios are good for investors who are deathly scared of losing money and are content with earning a modest positive return year over year. They are also great for investors who are nearing retirement, as mentioned above.

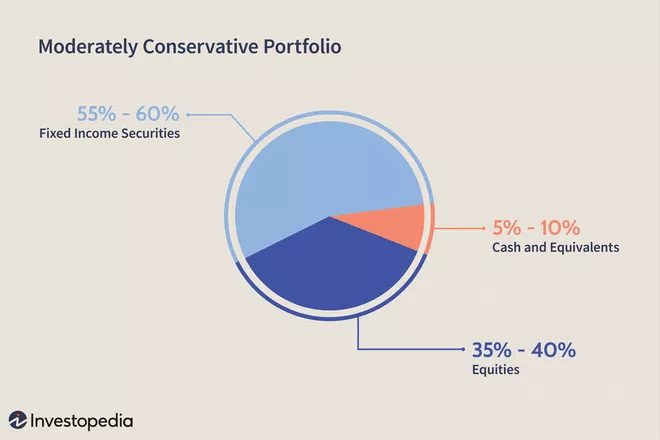

Moderately Conservative

This type of portfolio is great for the investor who still prioritizes capital preservation but also wants a little bit of exposure to more volatile stocks for potentially higher returns. Moderately conservative portfolios hold more equities (stocks, REITs, etc) and less fixed income (bonds, GICs, etc). This type of portfolio is great for someone nearing retirement but still looking to grow their wealth a bit more. It is also great for investors of all ages who want a bit more potential for capital gains.

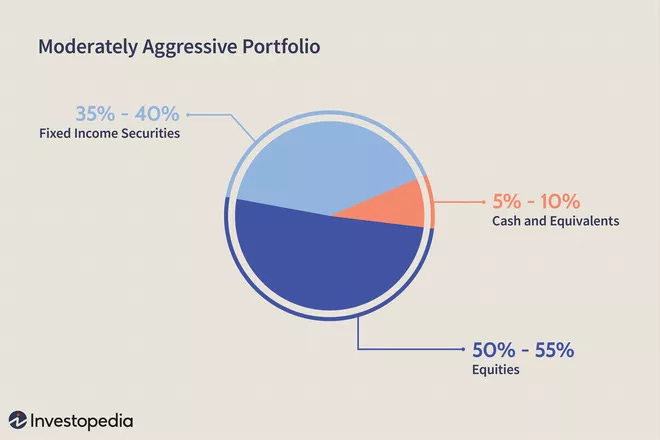

Moderately Aggressive

This type of portfolio strikes the best balance between fixed-income securities and equities. Many moderately aggressive portfolios will often be split 50/50 right down the middle between the two, giving great exposure to both growth and income. These types of portfolios are for younger investors with longer time horizons and more time to recover from errors and losses. In my personal opinion, this is the optimal asset allocation for myself, however, instead of fixed income securities, I buy index fund ETFs which are slightly riskier but give me a solid foundation.

Very Aggressive

The type of portfolio investors (new ones in particular) seem to find the most appealing. It does give you the most opportunity at making a lot of money, but the reverse is also true. These portfolios consist mostly of equities, so the value is always fluctuating. Imagine if you went even more aggressive and your portfolio was 90% stocks. Now imagine how that would have performed during COVID. My guess is that you would have had a tough time sleeping a night. But of course, when the market is in a bull run (going up) these types of portfolio allocations are what everyone wants to have. Can’t have your cake and eat it.

Your Cash Position 💰

A very much neglected part of the portfolio and sometimes the most important. How much cash you hold depends on how liquid you want to be. But it will also depend on your future outlook of the market. Of course nobody (and I mean nobody) can predict what the market will do in the long run. But in the short run, it’s possible to gather enough information to make an educated guess about where the market is moving.

If that guess tells you the market is going to continue falling, then it may be a good idea to hold more cash.

For example, after the market crashed in 2020, we quickly saw stocks (specifically tech/SaaS) rise very quickly and hit all-time highs. At this point, and if you’ve been invested long enough, one could say “what goes up must come down”.

Sure enough, tech stocks and the entire industry came crashing down and all hell broke loose. This would have been a great time to have some free cash and pick up shares at MASSIVE discounts.

In Conclusion

Your optimal allocation depends on so many things that are personal to you and only you. How you decide to allocate your money is a decision nobody else can realistically make for you with complete accuracy.

One thing to keep in mind is that your portfolio allocation will change over time. As you age, raise a family and gain more dependents, you may want to decrease your level of risk because now your financial decisions are affecting more than just yourself. Just something to think about.