Investing beyond traditional asset classes

There are more ways to create wealth than just with stocks

Welcome to The Profit Zone, where 12,000+ millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on Substack, providing you with weekly insights on the stock market and tips you can’t find anywhere else.

Happy Monday!

Let’s start the week off strong.

👉 Indexes notching 4 straight weeks of gains ✅

👉 Retail shares are up during Black Friday 🛒

👉 Investors are becoming Bullish 📈

👉 A detailed breakdown of alternative assets 💰

Consider Going Premium

Being a free subscriber gets you access to our newsletter, but becoming a premium member gets you access to the meat and potatoes.

As a premium member, you get:

Deep dives into my favorite stocks

Portfolio management tips I don’t share anywhere else

My watchlists

What I’m buying/selling and why

What industries I’m looking at investing in

Access to the entire newsletter

You can test the waters before making a commitment.

Consider joining on a 14-day FREE trial.

Click below to unlock premium content free of charge for 14 days.

Tweet of the Week

Allow me to expand on this…

Your Netflix subscription, your phone bill, your gym membership and your mortgage are all somebody else’s passive income.

A monthly payment you make to someone else, who doesn’t trade an hour of their time to earn it.

While some of these are of course necessities, you need to figure out a way to put yourself on the other side of the cash register to balance the playing field.

The easiest way to do this is to buy assets that generate cash flow.

At the end of the day, net worth doesn’t matter.

Your cash flow does.

You could have a $5 million net worth but it means nothing if that money isn’t generating a monthly return.

The cash flow is what sets you free from having to work for a salary.

And freedom is what we chase.

Advertise with Us

Do you have a business that needs some more exposure?

Want to get more eyes on your products?

Advertise to 12,000+ investors with this newsletter who are hungry for financial content.

Or advertise on our Twitter and Instagram.

Click here to book with us.

Weekly Market Update 🗒️💡

Indexes

The Dow Jones rose 1.27%% this past week, while the S&P saw a jump of 1% and the Nasdaq added 0.89%.

This marks 4 consecutive weeks of positive gains for the 3 major indexes, making it the largest streak for the S&P 500 and the Nasdaq since June 2023.

The Dow hasn’t posted this many consecutive weeks of gains since April 2023.

These gains come as a result of Treasury yields hitting a multi-month low in hopes that inflation is starting to cool down. The market believes the Fed may be done raising rates, and when that becomes the general consensus, money starts to flow back into the market.

The CIO at Horizon Scott Ladner mentions that the market is starting to agree that 4-5% rates are the right level for 2024 and one that the equity market can handle going forward.

Retail

Surprise!

Major retail shares are on the rise as Black Friday sales flooded your email inboxes.

Walmart WMT 0.00%↑ shares rose 0.9% while Target TGT 0.00%↑ saw an increase of 0.74%. Amazon AMZN 0.00%↑ shares saw an increase of 0.02%.

Despite the increases, TD Analyst Oliver Chen mentions that traffic is to remain flat this Black Friday season as consumers are more budget-conscious and spending has pulled back on gifts during the holiday season.

The Bulls and The Bears

Investor bullishness on the stock market over the next 6 months rose again for the 3rd straight week, from 43.8% to 45.3%.

This marks the highest level of optimism in the last 4 months since August 2023.

Bullishness has stayed above the historical average of 37.5% for a 3rd consecutive week.

Investor confidence is rising, money is flowing into the market, and inflation consensus’ are leveling out.

Could we see new all-time highs in the market? It seems likely.

Meanwhile, bearishness fell to 23.6% this past week, down from 28.1%. This marks the lowest pessimism in the market since August 2023 and the 3rd straight week where bearishness has stayed below the long-term historical average of 31%.

This news isn’t great for contrarian investors who try to bet against the market, but it is good news for those of us who have longer time horizons and have been adding shares at lower prices for the past year.

Stocks Hitting All-Time Highs

Some companies setting all-time highs:

Chipotle Mexican Grill trading at all-time high levels since its IPO in January 2006

Ingersoll-Rand trading at all-time high levels since 1972

Progressive trading at all-time highs back to its IPO in 1971

Visa trading at all-time high levels since its IPO in March 2008

My Take

As we quickly approach the Holiday season large retail stocks will continue experiencing a spike in revenues.

Money is starting to flow back into markets putting upward pressure on prices.

Now would be a good time to accumulate some dry powder and have it ready to jump in the market at a moment’s notice.

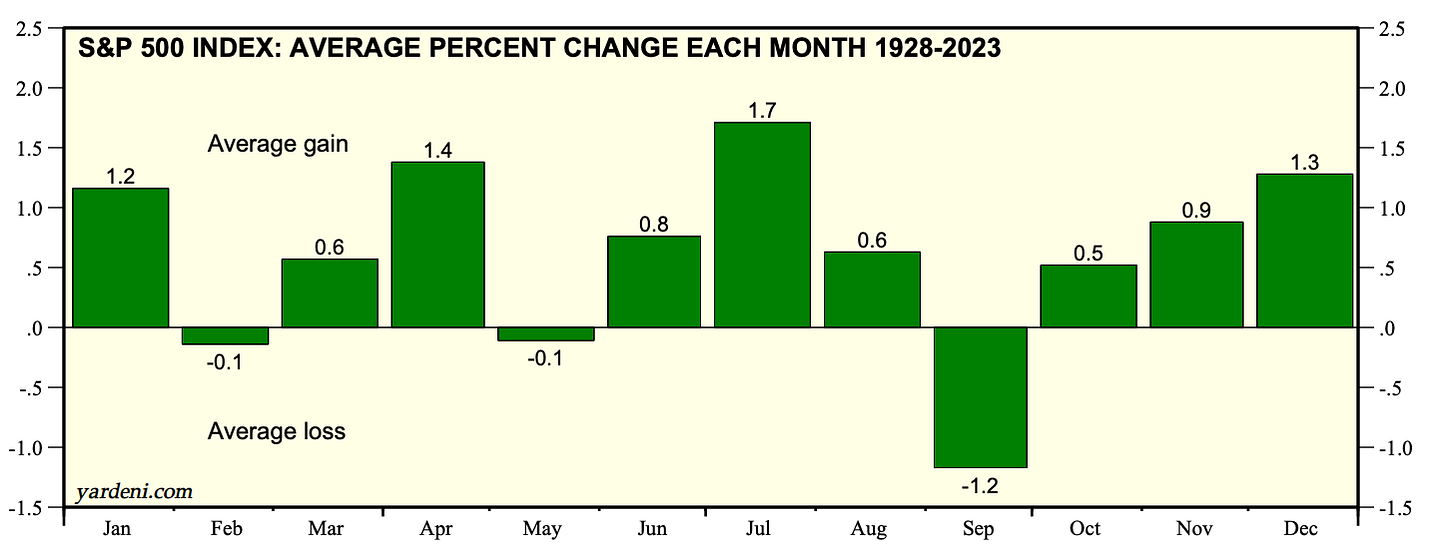

November and December have historically been great months for the S&P 500, rising 0.9% and 1.3% in November and December respectively from 1928-2023.

And since 1950, November has been marked as one of the best months for stock performance.

Call me crazy, but when we see a run like this it’s only a matter of time until market news creates a pullback of some sort.

When that happens, I will be the first to scoop up shares lowering my average costs on my favorite positions.

In your pursuit of building a bulletproof investment portfolio…

The allure of traditional investments like stocks and bonds can often blind you.

But, just as the world of entrepreneurship offers diverse opportunities, so does the realm of alternative investments.

Take a step back from the stock market hustle so we can explore the possibilities beyond conventional asset types.

So, what exactly are alternative investments?

Alternative investments encompass a range of options beyond the stock market.

These include hedge funds, private equity, venture capital, and commodities.

Each with its own unique characteristics and potential for passive income generation.

Obviously, you need to understand the risks and rewards associated with these alternatives first.

So let’s break them down: