Is META alive again? It never died...

Welcome to the +118 subscribers who joined this past week and are now part of 9,806 millionaires, CEO’s and high-performing entrepreneurs who read the #1 financial newsletter on Substack.

Please note this is a paid post. Paid subscribers get access to information free subscribers don’t get to see. I share deep dives into my favorite stocks, let you know what I’m buying and what’s on my watchlists, portfolio management tips and much more.

If you want the full experience, consider going paid for the price of lunch.

Cash Flow University

Are you tired of being tied down to a 9-5 job with limited financial freedom?

Do you want to learn how to build a stream of passive income that will eventually allow you to leave your 9-5 for good?

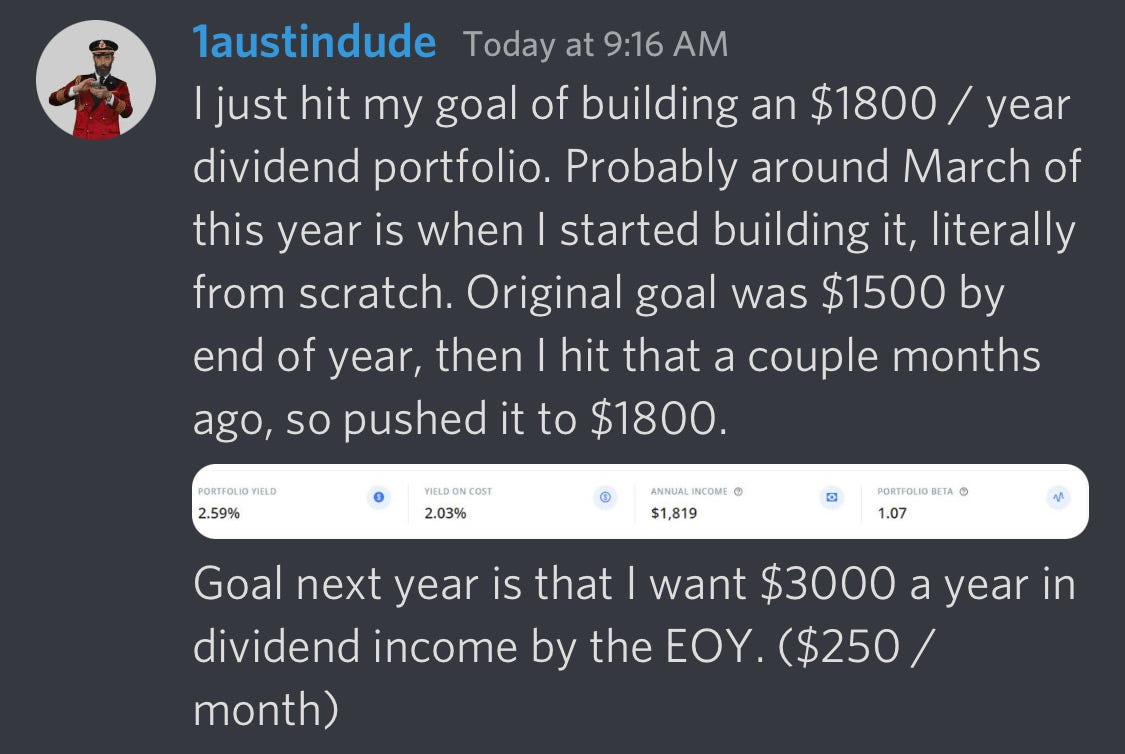

Join our online discord community today and connect with like-minded individuals who are on a mission to achieve financial independence. Our community is filled with experienced investors, financial experts, and individuals just like you who are all working towards building their cash flow.

With our community, you'll have access to resources and knowledge, including daily discussions on investment strategies, market analysis, and so much more.

Our members are always eager to share their experiences, offer advice, and provide support as you hop on the train toward financial freedom. Whether you're a seasoned investor or just starting out, our community has something for everyone.

Take 20% OFF for your first 3 months!

Use code: PRES20

What are you waiting for? Join below.

See you inside.

Market Update 🗒️💡

Things are turning sour in the Western world as prices rise, and uncertainty amongst investors and retail traders increases. The price of Brent Crude Oil (BZ) rose more than 10% in the last week as Russia notified the world that they will be cutting oil production by 500,000 barrels. Also, OPEC+ is cutting production by 2 million barrels per day. Economies dependent on importing oil will be seeing a major setback in controlling inflation and interest rates.

Oil and gold are strong indicators of the global economy's health. Many articles claim that as oil prices rise, so does inflation, and with these new cuts by OPEC+ we are going to see a significant strain on the world economy in the coming months. Increasing oil prices are projected to rise over $100 a barrel, and with gold dropping 100 points, we have a reverse correlation indicating that the global economy is in poor health and a recessionary period is perhaps around the corner.

Buckle up my friends.

My take: build a larger cash position just in case.

Was META ever dead?

The short answer: ABSOLUTELY NOT 🙅♂️

Over the past 1.5 years, META’s performance (Previously Facebook) has been incredibly underwhelming. To the point where investors have lost all confidence in the man, the myth, the legend we call Mr. Mark Zuckerberg.

But why?

Has something changed fundamentally about the company? Or is this just an overreaction to market news? As was the case with many high-profile technology companies in the last couple of years.

In today’s issue of The Profit Zone, we’re going to be doing a deep dive into META’s most recent earnings report. The good, the bad, and the ugly. And at the end of the post, I’m going to be giving you my thoughts on this company and where I believe it’s headed in the future.

I Read META’s Earnings Report So You Don’t Have To 📕

META is a social media platform that allows users to create profiles, connect with friends and family, as well as other people they know, to share updates, photos, videos, links, and pretty much anything you can imagine.

It was launched in 2004 and has since grown into one of the largest social networks in the world, with billions of monthly active users. Facebook also offers features such as groups, pages, and events to help people discover content and join new communities they may be interested in. The company also operates several other apps, including Instagram and WhatsApp, under the umbrella of META.

The company's community has continued to grow, reaching ~2 billion daily active users. Zuckerberg has attributed the growth to the company's artificial intelligence discovery engine and Reels feature on the app.

He adds that the company's focus for 2023 will be to improve efficiency and become a more “agile” organization. Agility is key in a quickly changing environment. Being able to pivot at a moment’s notice is a luxury only some companies have, and they’re usually the companies with the most free cash flow on hand.

Let’s highlight some important numbers from 2022.