Market caps: don't buy another stock until you read this

Welcome to the +56 subscribers who joined this past week and are now part of 6,808 millionaires, CEO’s and high-performing entrepreneurs who read the #1 financial newsletter on Substack.

If you’re enjoying The Profit Zone, please take a few seconds out of your day to share this newsletter, leave a like, or a comment. It means the world to me and costs you a total of $0. Thank you for the support! It doesn’t go unnoticed.

Tweet of the Week

Dividends covering your car payment. If you’re going to own liabilities, you might as well get your assets to pay for it.

Cash Flow University

We’re building the biggest online financial community and we want you to be a part of it.

Are you interested in building cash flow?

How about starting an Airbnb business?

Or maybe selling covered calls to generate more income on stocks you already hold?

We go into detail on all of these topics in Cash Flow University, and many more.

Don’t miss the chance to join this growing community of like-minded investors all striving for the same goal: financial freedom.

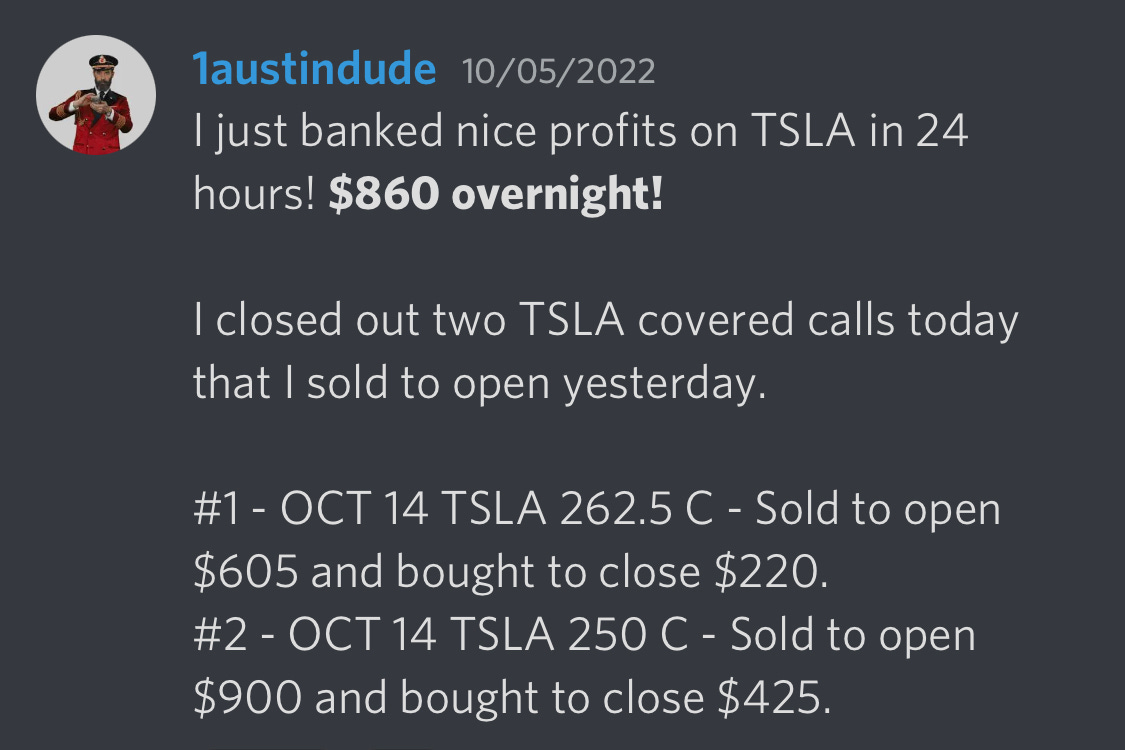

Here’s a win from one of our members 🏆

Before we dive into the pros and cons of each market cap, it’s important to understand exactly how big each market cap is.

Micro Cap: $50 million to $300 million

Small Cap: $300 million to $2 billion

Mid Cap: $2 billion to $10 billion

Large Cap: $10 billion to $200 billion

Mega Cap: $200 billion and more

The next step is to define the word “cap” A.K.A. capitalization. A market capitalization or “market cap”, is the term used to estimate the total dollar value of a companies outstanding shares.

To get this number, all you have to do is multiply the company’s outstanding shares by its share price.

So let’s say Company A has a share price of $100 and had 1 million shares outstanding. Its market cap would then be $100 million ($100 x 1 million shares). By definition, this company would be classified as a micro cap.

The market cap is a good way for investors to judge the size and value of the company, which can be important information when analyzing an investment.

Pros of Micro & Small Cap Companies

As investors, we have to remind ourselves that most successful large cap companies once started out as a small business. Small caps give investors the chance to enter into a business in its early stages of operation, where they’re coming out with new product lines, entering new markets and establishing their customer bases.

When it comes to investing in micro and small cap companies, it’s important to realize that these stocks just have low values, and they can grow in ways that large and mega cap companies cannot.

For example, Apple is not going to be the next Apple because it’s already itself. There comes a point where growth slows down, even at the highest level of success. Micro and small cap companies have the luxury of a larger runway for growth, which can be beneficial for investors, especially if you are looking for the next Apple.

I’d give you some examples of micro and small caps but you’ve likely never heard of them.

Cons of Micro & Small Cap Companies

Investing in micro and small caps is not all sunshine and rainbows. With smaller capitalizations comes more volatility. Because these companies are still finding their way, they’re naturally riskier investments and therefore making the stock more volatile in nature. These are not the types of companies you want to be holding during a recession, but when an economy emerges out of a recession and into an expansion, small caps often outperform the market.

Another con (which could also be a pro depending on how you look at it) is the fact that small cap companies are more prone to mergers & acquisitions. Whether or not this is a good or bad thing depends on who is acquiring them and for what reason, but keep in mind that companies with smaller valuations are more commonly bought out or merged with others.

Pros of Large and Mega Cap Companies

Large and mega cap companies dominate their industries and are typically very stable. These often include defensive/blue-chip stocks, the ones that don’t fall too much with the market but don’t rise too much either. They are very stable and perform well during periods of market volatility. Categorized by dependable earnings, solid reputations and good brand awareness, these types of companies tend to be less volatile and reward investors with stable and growing streams of dividend income.

Some examples of large and mega caps include Microsoft, Apple, Amazon, Google, McDonald’s, Cisco, and Verizon.

Cons of Large and Mega Cap Companies

As with anything, there are cons to investing in large and mega cap companies. Some of these cons include the fact that these companies are not meant for risk takers because they won’t generate 100x returns. They are attractive for the long-term investor who wants to build wealth over time, rather than the speculative investor who wants to make a quick buck overnight. So if you’re in a bull market, large and mega caps will provide investors with returns that are sometimes underwhelming.