My favourite real estate ETFs + 6 gems in the market right now

Become a real estate investor without the headache of being a landlord

Welcome to the +180 subscribers who joined this past week and are now part of 11,008 millionaires, CEO’s and high-performing entrepreneurs who read the #1 financial newsletter on Substack.

*This is sponsored advertising content. Learn more about Snowball Analytics here.

Tweet of the Week

One thing I love about investing is earning passive income. I’ll always be a firm believer that every portfolio should generate at least some sort of cash flow. Whether it’s through bonds, dividend stocks, or ETFs.

Some of the highest-paying dividend stocks are in the real estate sector. Which is why they make up more than 50% of my total portfolio.

But having all of your eggs in one basket is never a good idea, which is why you can get the best of both worlds with REIT ETFs.

REIT ETFs can be a good investment for several reasons:

Diversification: REIT ETFs allow investors to diversify their portfolios by investing in a basket of real estate assets. By owning a single REIT ETF, an investor can gain exposure to a diverse range of properties and markets, reducing the total risk of their portfolio.

Regular Income: REIT ETFs provide regular income in the form of dividends, which is attractive for investors seeking extra cash flow.

Liquidity: REIT ETFs are traded on major exchanges, making them easy to buy and sell. That means you can quickly liquidate your positions if you need the cash.

Cost-effectiveness: REIT ETFs are generally less expensive than investing in individual REITs, if you have to pay trading fees. Also, many are passively managed which means the fees you pay will be a lot less than their active counterparts.

Exposure to Real Estate: REIT ETFs offer investors exposure to the real estate market without the headache of having to be a landlord or manage properties. You won’t be getting called at 1 AM about a clogged toilet or have to drive 2 hours to change a lightbulb.

In today’s post, we’ll be doing a brief overview of a few of my favorite real estate ETFs. These ETFs will help you generate some extra income while diversifying your portfolio so you don’t lose sleep at night.

Vanguard Real Estate ETF (VNQ)

The Vanguard Real Estate Trust offers investors exposure to U.S. equity REITs, with a small allocation towards specialized REITs and real estate firms. The goal of the fund is to track the return of the MSCI US Investable Market Real Estate 25/50 index. The fund currently holds 166 stocks and has $39 billion in assets under management (AUM).

This is a great option for investors looking to gain exposure to some of the largest and most powerful REITs in the US.

Top 10 holdings (48% of the total fund)

Dividend yield: 4.11%

MER: 0.12%

10-year performance: 5.04%

Vanguard Global ex-U.S. Real Estate ETF (VNQI)

The Vanguard Global ex-U.S. Real estate ETF holds 668 companies in developed and developing markets outside of the U.S. The fund is split approximately 80% developed and 20% emerging markets, with a good spread between large caps (25%), medium caps (28%), and small caps (26%), with the rest of the holdings representing companies that fall on the cusp of medium/large and medium/small.

This fund is a good option for those looking outside of the US for real estate opportunities.

Top 10 holdings (18% of the total fund)

Dividend yield: 4.70%

MER: 0.12%

10-year performance: 0.53%

Real Estate Select Sector SPDR Fund (XLRE)

The companies selected to be held within this fund are part of the S&P 500 Composite Stock Index. This fund includes companies from the following industries:

Real estate managament

Real estate development

Note: it excludes mortgage REITs

The fund holds $4.35B in assets under management

Here is a breakdown of the sectors included in the fund and their respective weightings.

Top 10 holdings (63% of the total fund)

Dividend yield: 3.62%

MER: 0.10%

Performance since inception (2018): 22.94%

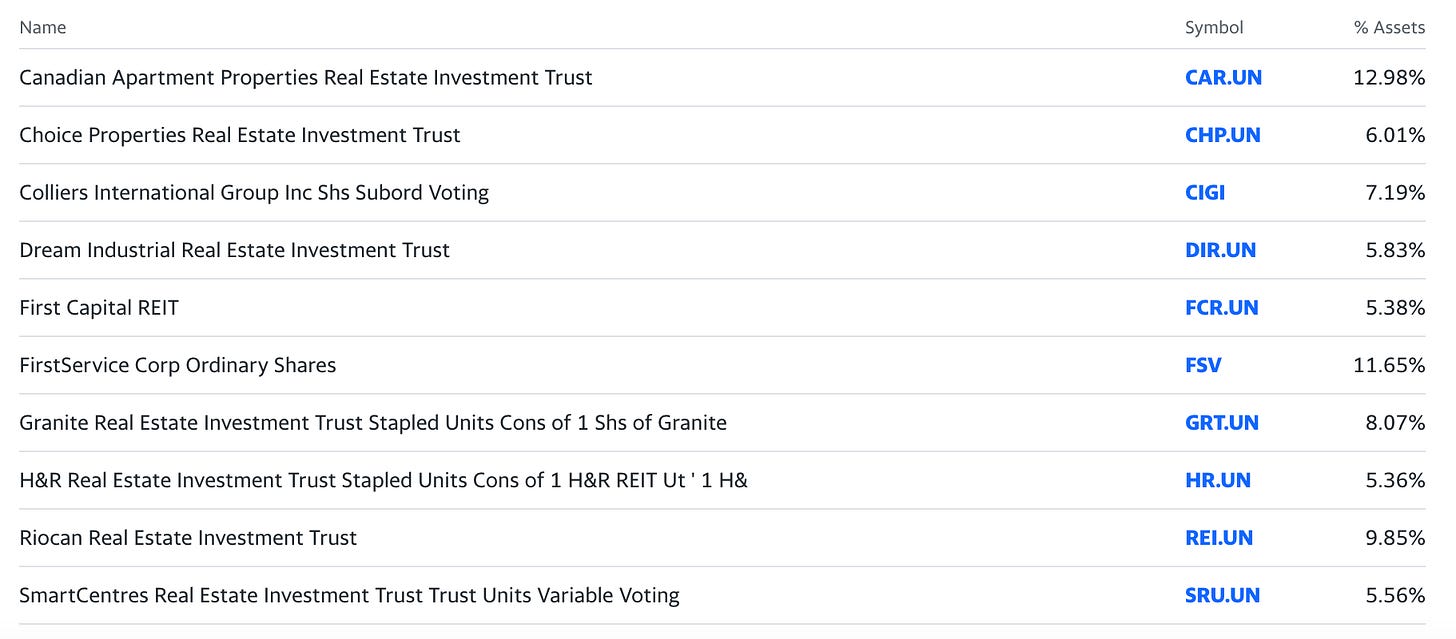

Vanguard FTSE Canadian Capped REIT Index ETF (VRE)

Vanguard FTSE Canadian Capped REIT Index ETF seeks to track the performance of a broad Canadian real estate equity index. It invests primarily in stocks of companies in the Canadian real estate sector and offers passively managed exposure to Canadian large, mid, and small-cap stocks. The fund holds 17 stocks and $327M in assets under management.

This fund is a great option for all of you Canadian investors, especially those living in Toronto or Vancouver, who want to enter the real estate market but don’t have thousands of dollars laying around for a downpayment.

It will provide you with diversified exposure to some of Canada’s largest REITs and benefit from the income they generate on a monthly basis.

Top 10 holdings (78% of the total fund)

Dividend yield: 4.25%

MER: 0.35%

10-year performance: 5.08%

BMO Equal Weight REITs Index ETF (ZRE)

The BMO Equal Weight REITs Index ETF replicates the Solactive Equal Weight Canada REIT Index. It invests in Canadian REITs and holds securities in the same proportion as they are reflected in the index. This fund pays a monthly dividend to its shareholders and holds $610 million in assets under management.

Top 10 holdings (50% of the total fund)

Dividend yield: 4.93%

MER: 0.61%

10-year performance: 5.61%

Some Gems in the Market Right Now (premium content)

Stock picking is difficult. Sometimes it can feel like you’re throwing a dart at a board and hoping it hits the bullseye. But you can make picking stocks easier by filtering out all the ones you DON’T want to buy, leaving you with a pool of stocks that could be potential candidates for what you’re looking for. This way you can ensure that the stocks you’re investing in will give you the best chance of growing your wealth.

The stocks I’m about to list have been screened for the following characteristics:

$10 billion+ market cap (we love large established companies)

Quick and Current Ratio over 1 (need to be able to cover their debt obligations quickly)

5-year EPS growth forecast over 15% (a great sign of future growth)

Next year projected EPS growth of 5% or more (another great sign of future growth)

Payout ratio under 60% (we don’t want our dividend stocks paying out too much of their earnings to shareholders)

Analyst recommendation of BUY or better (usually a good sign when Wall Street labels the company as a BUY)