(PRO TIP) how to figure out what you should be paying for your stocks

Welcome to the +82 subscribers who joined this past week and are now part of 5,657 millionaires, CEO’s and high-performing entrepreneurs who read the #1 financial newsletter on Substack.

My name is Alex and I love creating streams of passive income. My goal is to help you do the same.

If you’ve enjoyed The Profit Zone please take 30 seconds out of your day to share this newsletter, leave a like, or a comment. It means the world to me and costs you a total of $0. Thank you for the support! It doesn’t go unnoticed.

Announcement

Lately I’ve been enjoying staking my crypto on the platform crypto.com. So far I’ve earned $38 in crypto interest staking Bitcoin and Ethereum. I love passive income and staking is like earning a dividend on your crypto.

If you want to check out crypto.com click here for my referral code, we both get $25 when you stake for a Ruby card or above.

Announcement (Final Notice)

If you haven’t done so yet, you can now download the Substack app right to your smartphone so you can have all of your newsletters in one place. See link below.

With the app, you’ll have a dedicated Inbox for my Substack and any others you subscribe to. New posts will never get lost in your email filters or stuck in spam. Longer posts will never cut off by your email app. Comments and rich media will all work seamlessly. Overall, it’s a big upgrade to the reading experience.

The Substack app is currently available for iOS. If you don’t have an Apple device, you can join the Android waitlist here.

The Intrinsic Value

“Price is what you pay, value is what you get” - Warren Buffet

The stock market is a place where everyone knows the price, but very few know the value. Today’s newsletter will help you change that.

Everything has a price tag on it, not just in the stock market. Food has a price. Cars have a price. Houses have a price. Vacations have a price. What we fail to understand is the value behind that item, or experience, or asset.

The market lets you know what other investors are willing to pay (right now) for a stock. Since every investor is faced with the challenge of trying to figure out if the stock is overpriced, underpriced, or priced at fair value, it helps to know how to find the intrinsic value so you can make better and more informed investment decisions.

It’s logical to assume that most long term investors are indirectly value investors, whether you like it or not. Your goal is to find companies that are trading below what they’re worth so the value of your investment can increase over time as the true value gets priced in. That’s fundamental analysis at a very base level. And it’s a skill every investor should learn.

What is Intrinsic Value?

Intrinsic value is a measure of what an asset is worth, not what you paid. For example, if you bought a house for $500,000 but 3 other similar houses just sold for $600,000, then it’s worth $600,000.

When it comes to the stock market, intrinsic value is based on an asset’s financial performance. This type of calculation has a lot more truth and substance to it and is definitely more reliable than your buddy saying “trust me bro, this stock is going to the moon”. We’ve all heard that one before.

The main metric used for analyzing a company’s financial performance is called Discounted Cash Flow (DCF). You’ll see me referencing this acronym (DCF) many times so make sure you’re familiar with what it means.

DCF is a valuation method used to determine the intrinsic value of an asset based on its return of future cash flows.

The next section will teach you exactly how to figure out how much you should be paying for a stock today.

How to Calculate Intrinsic Value

To use the DCF model, you need 3 things:

Projected/estimated future cash flows of the company

Discount rate

Terminal value

Here’s the formula:

We’ll be going through each one in detail below.

#1 - Projected/estimated future cash flows of the company (DCF)

The single best way to estimate future cash flows is to take the cash flows from the past 12 months and assume a certain growth rate to project those cash flows into the future. There are 2 kinds of cash flows you can use when doing DCF. The first one is free cash flow to firm (FCFF) and the other is free cash flow to equity (FCFE).

FCFF is the cash flow that is generated by the entire business, FCFE is the cash flow allocated to shareholders only. For the sake of simplicity and my personal preference, we will be using FCFF to get a broader idea of the company’s cash flows.

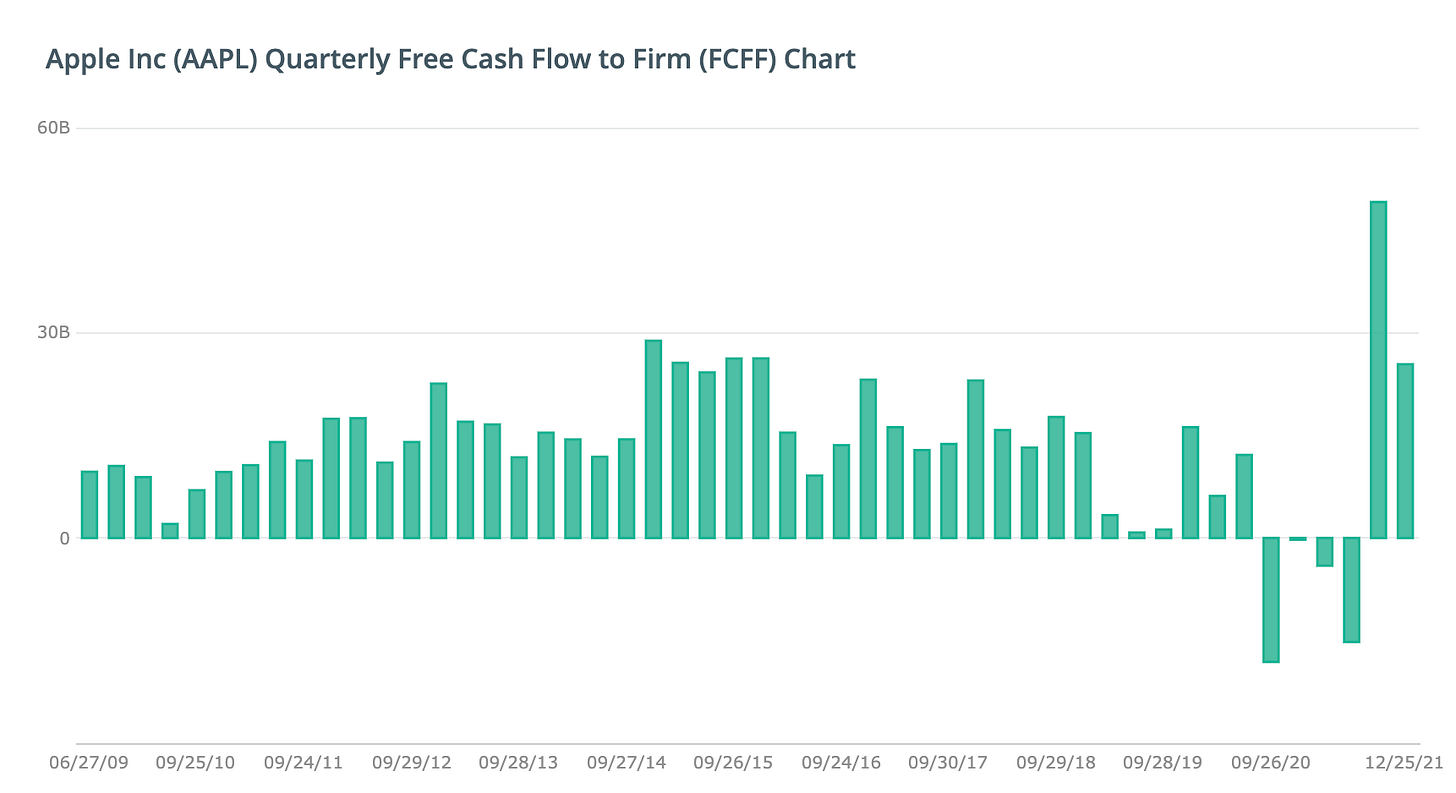

You can find this number through a quick google search. Here is Apple’s FCFF by quarter since 2009.

#2 - Discount rate (r)

The discount rate is the interest rate used in DCF to determine the present value of future cash flows. Future cash flows are impacted heavily by the discount rate. The higher “r” is in the equation, the lower the present value of future cash flows (and vice versa).

According to Warren Buffet, an appropriate discount rate to use is the risk-free rate or the yield on the 10-year or 30-year Treasury bond.

Personally, I use a range of discount rates myself when doing DCF as a sensitivity analysis.

#3 - Terminal value (CFn)

It’s important to pick a time horizon for how far in the future you’re going to be projecting the cash flow of a company. DCF models average around 5-10 years but remember, the further you project the more difficult and inaccurate projections become.

The terminal value is just a multiple of the cash flows in the final year. If you want to get more in-depth and calculate it yourself, here is the formula.

[FCF x (1 + g)] / (d – g)

Where:

FCF = free cash flow for the last forecast period

g = terminal growth rate (the constant rate at which the company is expected to grow year over year)

d = discount rate

If absolutely none of that made sense to you…

Below is a quick 10-minute video that will explain how to find the intrinsic value of a company using nothing but Excel and Yahoo Finance.