Welcome to The Profit Zone, where 12,000+ millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on Substack, providing you with weekly insights on the stock market and tips you can’t find anywhere else.

Happy Monday!

Let’s start the week off strong.

👉 What is an IPO? (free)

👉 How do companies go public? (free)

👉 A list of companies that have recently IPOs and are set to make their debuts (premium)

👉 3 stocks I can’t stop buying (premium)

Consider Going Premium

Being a free subscriber gets you access to our newsletter, but becoming a premium member gets you access to the meat and potatoes.

As a premium member, you get:

Deep dives into my favorite stocks

Portfolio management tips I don’t share anywhere else

My watchlists

What I’m buying/selling and why

What industries I’m looking at investing in

Access to the entire newsletter

You can test the waters before making a commitment.

Consider joining on a 14-day FREE trial.

Click below to unlock premium content free of charge for 14 days.

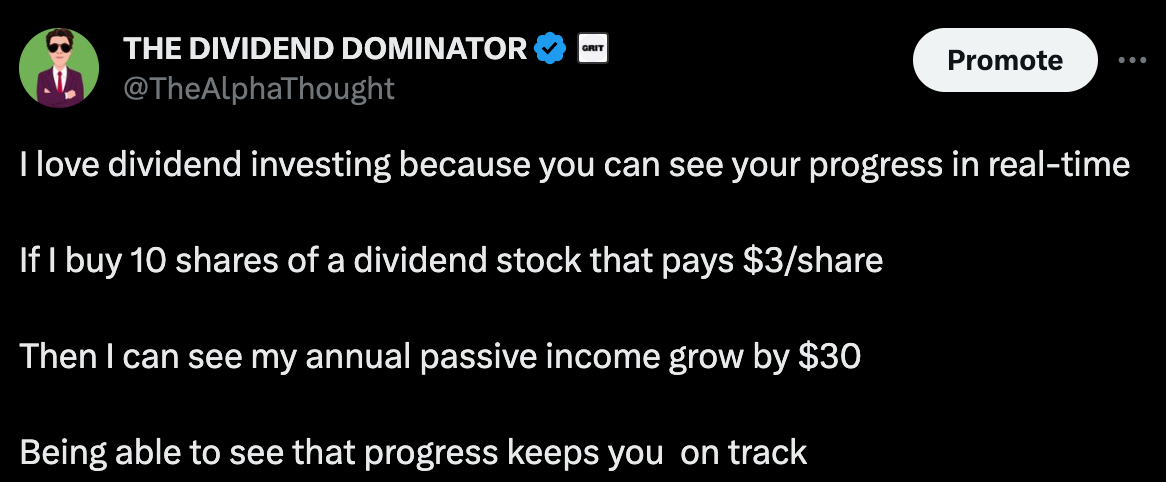

Tweet of the Week

Advertise with Us

Do you have a business that needs some more exposure?

Want to get more eyes on your products?

Advertise to 12,000+ investors with this newsletter who are hungry for financial content.

Or advertise on our Twitter and Instagram.

Click here to book with us.

Weekly Market Update 🗒️💡

Indexes

All 3 major indexes came in positive again for a 3rd straight week.

The S&P 500 added 2.2% while the Nasdaq rose 2.4% and the Dow closed 1.9% higher.

This is the first 3-week streak for the Dow and S&P 500 since July and the 1st for the Nasdaq since June.

Investor confidence in equities is on the rise.

The rise was a result of positive US inflation data that has given hope to investors that the Fed’s stance on hiking rates may have changed.

What goes down must go up?

Month to date gains

In November alone, the S&P 500 is up 7.6%, the Dow is up 5.7% and the Nasdaq has gained a whopping 9.9%.

The conversation surrounding inflation is slowing down

Company executives are becoming less concerned about projected inflation.

How do we know this?

Q3 earnings are nearly at the finish line, and only 275 of the S&P 500 companies who have reported earnings thus far have cited “inflation” as a significant factor during their analyst calls.

This is the lowest number since Q2 of 2021.

Financials and industrials are among the two sectors that are continuously reporting about inflation, as to be expected.

This is good news.

Real Estate

A sector I’ve personally been buying a lot of shares in. I write about this later on so keep reading.

Real Estate led all S&P 500 sectors this past week jumping 4.3%.

As inflation projections continue to become more conservative and talks about rising interest rates slow down, Real Estate will be among the sectors that will benefit the most.

The sector remains down 3.3% year to date, but at this rate I see that number shrinking as we head into year-end.

Holiday Spending

According to a Citigroup survey, consumers will be spending more this holiday season.

34% of a sample size of 2,800 people responded that they would be spending more during the holidays, while 27% said they would spend less.

Of those who answered they would be spending more, 46% responded that they would be “buying more for others” while 45% reported “having more money to spend”.

Alibaba to start paying dividends

Alibaba, the Chinese e-commerce giant, reported that it would pay its first-ever cash dividend in 2023.

The company approved an annual $0.125 per ordinary share or $1 per American depositary share cash dividend for the fiscal year.

IPOs - What are they and how do they work?

In the fast-paced world of entrepreneurship…

Where time is money and building a passive income source is the ultimate goal…

The allure of Initial Public Offerings (IPOs) is hard to resist.

Especially when it comes to achieving financial freedom – the key to taking care of your own and your family's financial concerns.

But what exactly is an IPO?

An Initial Public Offering is the process through which a private company becomes a public company by offering its shares to the public for the first time.

It's like the grand opening of a blockbuster movie but in the financial markets.

An IPO is a big step for a company as it provides the company with access to raising a lot of money.

This gives the company a greater ability to grow and expand.

The increased transparency and share listing credibility can also be a factor in helping it obtain better terms when seeking borrowed funds as well.

A company will consider going public once it reaches a private valuation of ~$1 billion, also known as “Unicorn Status”.

However, companies of all sizes can IPO provided they have strong fundamentals and meet listing requirements.

So how do companies IPO?

Think of it as a company's debut on the stock market.

The company hires investment banks, like Goldman Sachs or Morgan Stanley, to help determine the offering price, manage regulatory requirements, and sell shares to eager investors like yourself.

Now, the exciting part…

What are the potential rewards and risks?

When it comes to rewards, think of companies like Google and Facebook.

They were once IPOs and early investors saw huge returns as these companies continued to grow.

But like anything related to money and wealth, there are risks too.

For certain companies, the hype might not match the reality.

Which will make investors like you feel the burn of a poor IPO.

One thing we have to realize as investors is that many times the hype around an IPO is what drives the share price.

But like all good investors do, we have to understand the intrinsic value of the company before we invest in anything.

Do your due diligence.

Let's talk about these 10 hot prospects that are set to IPO soon or have already gone public:

Arm Holdings (ARM):

A British semiconductor giant with its chips in 95% of smartphones.

ARM could be your ticket to the future of technology.