the easiest way to conquer diversification

Welcome to the +42 subscribers who joined this past week and are now part of 6,049 millionaires, CEO’s and high-performing entrepreneurs who read the #1 financial newsletter on Substack.

My name is Alex and I love creating streams of passive income. My goal is to help you do the same.

If you’ve enjoyed The Profit Zone please take 30 seconds out of your day to share this newsletter, leave a like, or a comment. It means the world to me and costs you a total of $0. Thank you for the support! It doesn’t go unnoticed.

Announcement

No new announcements this week, let’s dive right into it.

Diversification, my old friend.

You’ve probably heard the saying “don’t put all of your eggs in one basket”. If you haven’t, then I’ll just assume you currently live under a rock. The saying started out as farmer’s logic, what would happen if the farmer were to fall on his way back from the henhouse carrying all of his eggs in one basket. Well, you can probably imagine that would be a pretty messy situation. However, this cliche saying extends far beyond just henhouses and eggs. It can be applied in so many ways, especially in investing and portfolio management.

What is diversification and why should you care about it?

Diversification, in a nutshell, is a portfolio that holds a collection of different investments that all work together to decrease the total risk of the investor.

Let me tell you what diversification IS NOT, so you can gain a better idea of what diversification IS.

Diversification IS NOT only buying individual tech stocks

Diversification IS NOT putting all of your money in Bitcoin

Diversification IS NOT only buying REITs

Pretty simple, right?

Here’s the thing about diversifying your portfolio - you’re more than likely going to experience smaller returns than if you otherwise hadn’t. But the opposite can also be true.

If you had put your life savings into Amazon (AMZN) back in 1997, you’d be extremely wealthy right now, assuming that you held the stock through recessionary periods and massive drawdowns.

But let’s go back to “all your eggs in one basket”. It’s also likely that you may have chickened out (punny) and sold some, if not all, of your position when the market started falling because that’s your entire life savings and that’s a scary position to be in. The fear of losing it all grows with the fewer baskets you have.

If the farmer were to put his eggs in 2 baskets instead of just 1, and has to make another trip back to the henhouse to grab the 2nd one, then there’s a higher chance of him making it back with at least 1/2 of the eggs (if he does fall on one of the trips).

What does a diversified portfolio look like?

For years financial advisors recommended a 60/40 portfolio for investors, sometimes regardless of your financial situation, income and age. This portfolio split allocates 60% to stocks and 40% to fixed-income investments like bonds. Sounds safe, right?

However, over time there was some pushback arguing that younger investors should hold larger positions in stocks and less in fixed income. The reasoning behind this was that you have much more time to recover from a bad financial loss at 20 than you do if you’re in your 50s most likely nearing retirement.

The issue with this thought process is that retail investors (almost always self-directing their own portfolios) would take on insane amounts of risk hoping for a big payout. Instead of trying to hit singles, investors were trying to knock it out of the park every time they stepped up to bat. Recipe for disaster. As well as a horrendous batting average.

One of the keys to a diversified portfolio is owning a wide variety of DIFFERENT stocks. This means healthcare, energy, retail, real estate, consumer staples, etc. There are 11 main sectors in the market but it’s a myth that you need exposure to every single one. Instead, focus on investing in the best performing sectors or maybe sectors that align with your investing strategy.

For example: dividend investors would be much more attracted to the financial, energy, and real estate sectors because these tend to pay out larger (and growing) dividends.

Additionally, investors should also focus on owning non-correlated investments. In other words, stocks that move in opposite directions of each other. For example, during the pandemic technology stocks were HOT. But on the other side of the coin, you couldn’t pay some people to buy financials or real estate stocks. If you were 100% invested in tech from 2020 to 2021, you did very well. If you were 100% invested in financials and real estate during the same time period, you likely wanted to rip your eyes out. The key is owning both so they offset each other.

How to diversify yourself + the easiest way to do it

I get asked all the time:

“How many stocks should I own?”

While there’s no exact answer to that question, I do believe in holding no more than 20 different companies. Of course, if those 20 companies are all tech stocks, then you’re obviously not diversified. If tech spending were to take a hit because of new government regulation, then you could find yourself buried in a very deep hole.

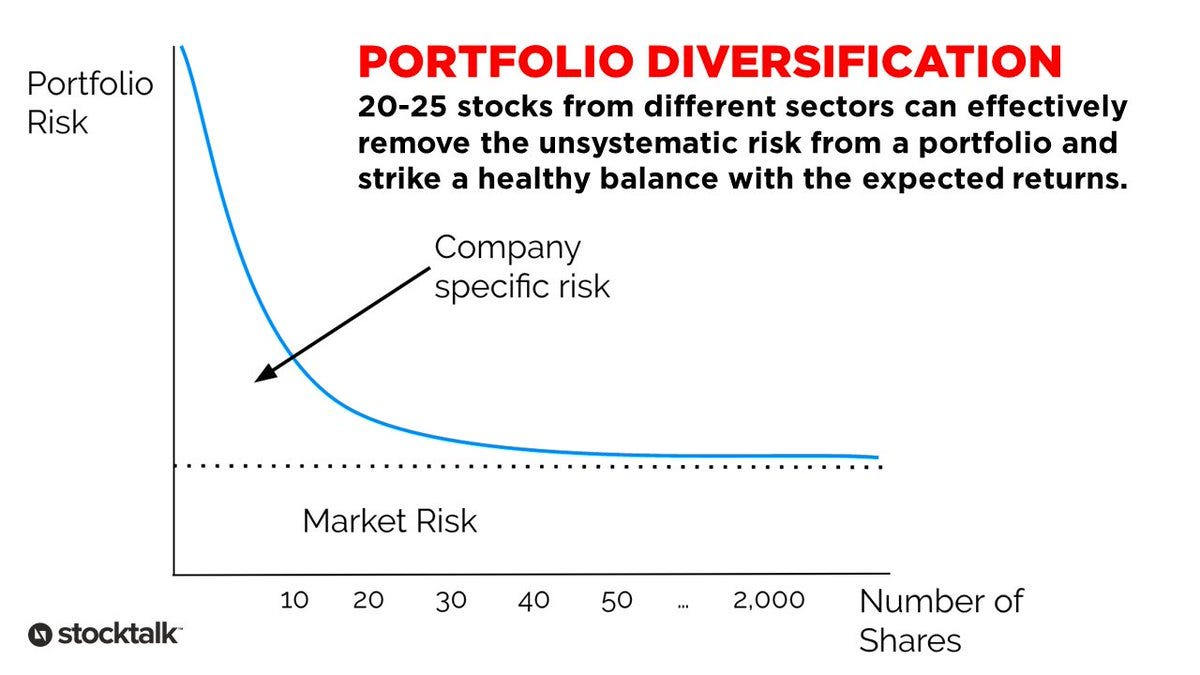

Below is a chart that illustrates that the effects of diversification lessen the more stocks you own. You can never get rid of market risk, but you can decrease the impact of company-specific risk by owning up to a certain number of stocks.

This “rule of thumb” is dependent on how much money you have to invest as well.

Do I recommend you own 20 different companies with $500? No.

Do I recommend you own 5 different companies with $500? Probably a better idea.

The last thing you want to do is spread yourself too thin. I say it all the time, you don’t want a slice of every pie, you want a slice of only the best pies.

If trying to figure out which pie is the best is just too much of a headache for you, and it is for a lot of investors (myself included), then consider buying an index fund. A simple fund like Vanguards S&P 500 ETF (VOO or VFV for Canadians) will aim to match the S&P 500’s performance for a very small fee. All you have to worry about is investing money into the fund every week/month/year and you’ll average around 10% per year, judging by the S&P’s past performance.

No need to read financial statements, keep up to date with breaking news, read charts or do ratio analysis. Just buy, hold and chill. It’s the easiest way to increase the diversification of your portfolio without having to piece stocks together like you’re playing Tetris.