Welcome to the +81 subscribers who joined this past week and are now part of 5,778 millionaires, CEO’s and high-performing entrepreneurs who read the #1 financial newsletter on Substack.

My name is Alex and I love creating streams of passive income. My goal is to help you do the same.

If you’ve enjoyed The Profit Zone please take 30 seconds out of your day to share this newsletter, leave a like, or a comment. It means the world to me and costs you a total of $0. Thank you for the support! It doesn’t go unnoticed.

Announcement

The Profit Zone will now be featuring guest writers so you can get a different perspective from other financial experts. I believe these guest posts will be a good way for you to learn about various financial topics I don’t usually speak about myself.

With that being said, this issue of The Profit Zone will be the FIRST-EVER guest post brought to you by my good friend and financial connoisseur Cade. You can follow him on Twitter here. Make sure to check out his courses as well as his own Substack newsletter (will be linked below), I promise you’ll learn a ton!

Without further ado, here is Cade on The ETF Showdown.

Hey there everyone!

A quick background on myself so you don’t read this article thinking “who even is this guy”?

My name is Cade, the face behind the Twitter account Cade Invests. I am 23 years old and will be graduating from college in May with a degree in Mechanical Engineering. Despite my engineering education, I developed an interest in the stock market early on and have been investing now for approximately 5 years.

Over that time I have attempted penny stocks, options, day trading, and just about every other get-rich-quick strategy in the stock market.

As you can probably guess, I didn’t get rich off any of those.

Thankfully the failures led me to long-term investing before I lost all of my money.

Over the years I have become a huge fan of ETFs, aka exchange-traded funds.

For those who don’t know, ETFs are essentially a basket of stocks. When you purchase an ETF you are buying a small piece of every stock in its “basket.”

Individual stocks are great, and I own a number of them myself, but it’s hard to beat ETFs since they are extremely passive and produce respectable returns.

One of the most popular ETFs in the US is QQQ.

What many investors don’t know is there are several variations of this one ETF and we are going to cover three of them in this email

The ETF Showdown: QQQ vs QQQM vs QQQJ

Which one is right for you? Let's break it down.

QQQ - Nasdaq 100 ETF

This is Invesco's main wheel. For any of you who are basketball fans and watch March Madness, you have likely seen the Invesco commercials pitching QQQ.

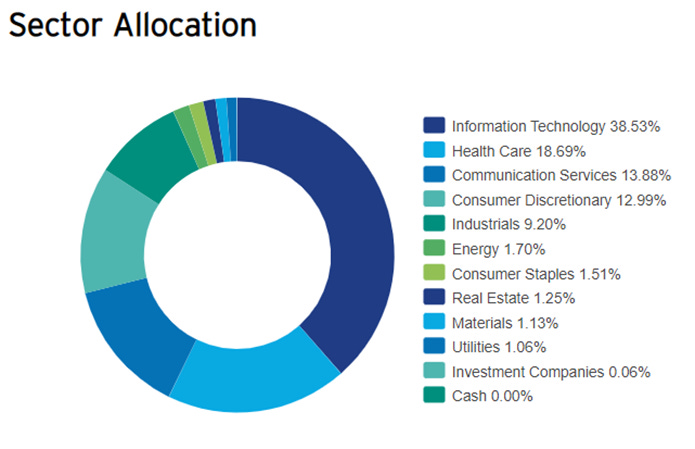

QQQ tracks the Nasdaq 100 index. While it’s often referred to as a tech ETF, QQQ also contains a number of companies in the consumer discretionary and communication services sector.

It has been around since 1999 and is one of the most popular funds out there today.

It's no slacker either, averaging 9.6% since inception.

The top 5 holdings of QQQ are Apple, Microsoft, Amazon, Tesla, and Nivida which account for approximately 40% of the fund.

Now, nothing is perfect, and for QQQ its biggest con is the expense ratio.

The expense ratio for QQQ is 0.2% meaning for every $10,000 you invest you will pay $20 in fees annually.

This might not seem very high until you compare it to Vanguard which has similar ETFs with expense ratios below 0.05%.

While this isn’t a deal-breaker for me, it is something you should take into account when analyzing QQQ.

Expense Ratio: 0.2%

Sector Allocation:

QQQM - Nasdaq 100 ETF

You read that right, QQQM tracks the same index and has the same holdings as QQQ.

So what’s the catch?

The main difference is the expense ratio and assets under management.

The expense ratio for QQQM is 0.15% making it 0.05% lower than QQQ.

While this isn’t very significant, it does add up over time.

Assets under management for QQQM are $1 billion while QQQ is $150 billion. The increased volume that QQQ experiences make it more liquid and a better choice for those buying or selling options and making large trades.

Another point is that at the time of writing this, the share price of QQQM is around $140, compared to QQQ’s of $340.

If you are a long-term investor who doesn’t have access to fractional shares, QQQM's smaller share price might serve you well.

Besides that, it's basically identical to its big brother.

Sector allocation: (same as QQQ)

QQQJ - NextGen 100 ETF

Meet the new kid on the block.

QQQJ tracks the Nasdaq NextGen 100 index. It follows companies next in line to join the Nasdaq 100.

Note that QQQJ has increased exposure to the health care sector and completely different holdings compared to the previous two.

The top 5 holdings of QQQJ are Trade Desk, Expedia Group, MongoDB, ON Semiconductors, and CoStar Group which account for 10% of the ETFs assets.

If these don’t sound very popular it’s because they aren’t, at least not yet.

Ideally, the stocks held in QQQJ will be the next Amazon and Apple.

The reason I like this ETF is instead of trying to go and pick that next 100x company, I can simply buy QQQJ and capture some of those gains through the ETF.

Remember that QQQJ is much more volatile and shouldn’t be viewed the same as QQQ or QQQM.

Think of QQQJ as a speculative investment.

Also, the expense ratio of QQQJ is 0.15%.

Sector Allocation:

Now for all my Canadian friends that might be reading this, I did a little research to try and find you a Nasdaq 100 ETF similar to QQQ and QQQM.

After digging around, I came across the fund ZNQ Unhedged.

ZNQ tracks the Nasdaq 100 and is unhedged meaning it isn’t associated with the Canadian currency.

However, if you are a Canadian please do your own research!

In summary:

QQQ - Nasdaq 100, best for those utilizing options or doing frequent/large trades.

QQQM - Nasdaq 100, cheaper expense ratio, favors long-term investors.

QQQJ - Next Gen Nasdaq 100, new concept, increased volatility with the potential for higher returns.

ZNQ Unhedged - Nasdaq 100, for Canadian investors

I hope you found this issue of The Profit Zone helpful!

If you’d like more content like this here are a few ways to do just that:

Follow me on Twitter (@cadeinvests)

Join my free email (cadeinvests.substack.com) where I give one intriguing quote, one topic on investing/business, and recap the best finance memes of the week.

Check out my 5 Star Rated Course Simply Invest With ETFs, where you’ll learn more about how ETFs work, different types of ETFs and how to analyze them so you can ensure your money is in good hands. Check it out here.

Till next time my friends, be sure to take it easy on Alex for me.

- Cade

Refer Your Friends and Win!

You can now refer your friends and win prizes!

For every milestone you hit, you will unlock a new prize. These include my top-rated dividend courses as well as a lifetime full membership to The Profit Zone!

Click below to start.

Some resources to help you make more money:

Money Mastermind - the “Money Bible”. Myself and 29 other expert creators teamed up to create the most all-inclusive 280-page finance book on the market. Over 100 topics about money including real estate, crypto, budgeting, dividend stocks, online business, and more.

The Complete Investors Accelerator Pack - everything you need to build a dividend portfolio that grows on itself. Learn more about dividend investing, how to analyze dividend stocks, what to do with your dividends and how to build a stream of passive income through the stock market.

The Molina Letter - the only product that’s helped me grow my Twitter account to 30,000 followers. Fill in the blank templates you can copy to help you create viral content with minimal effort. A big following gives you the key to creating products and making money online. There’s a reason why 500 people are subscribed to this letter.

TweetHunter - let the software do the tweeting for you. The only scheduler you’ll ever need. This tool makes me money in my sleep. Give it a try for free.

Hipster Budget Guide - having trouble saving money? Learning how to budget is your solution. This book will show you ways to save money you never even thought of. Worth every penny.

My 2 Cents - my other newsletter where I voice my personal opinions on life, money, and people. Beware: I have zero filter. But it might give you a good laugh.

Thanks for adding some Canadian content for your neighbors next door. Looking forward to more posts in the future 🤠

What's your opinion on the sector risk of these ETFs? I know the performance over the last decade has been staggering, but does that mean we can extrapolate this performance into the future?

Great read by the way!