The sweet and bitter truths about share buybacks

If you don’t know this, you’re not investing… You’re gambling

Welcome to the +39 subscribers who joined this past week and are now part of 11,336 millionaires, CEO’s and high-performing entrepreneurs who read the #1 financial newsletter on Substack.

If you want the benefits of being a premium subscriber, consider joining on a 14-day free trial.

You can test the waters before making any financial commitment.

Click below to unlock premium content.

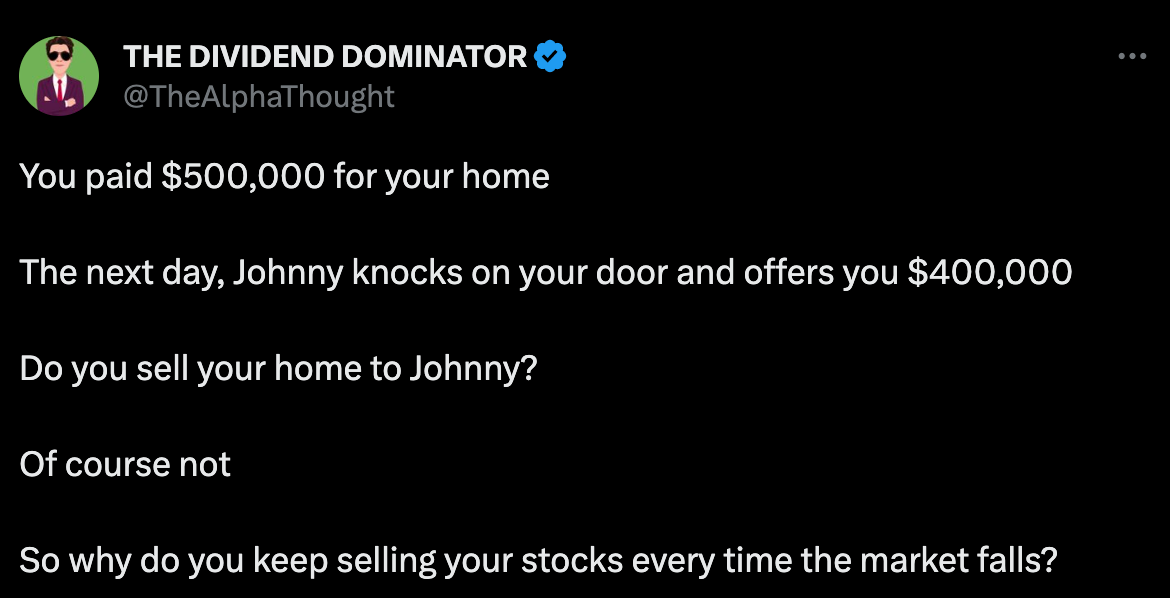

Tweet of the Week

Weekly Market Update 🗒️💡

Stocks finished lower last week with the S&P 500 falling 1.16%, the Nasdaq dipping by 0.92% and the Dow Jones losing 1.96%, marking the Dow’s worst weekly performance since March 2023.

Some Winners & Some Losers

Healthcare and mineral stocks are registering some of the biggest losses in the S&P 500 this past week.

As a whole, the healthcare sector is down 2.4% just last week alone.

Mineral stocks pulled the sector down by 1.3%, despite gaining 1.6% on Friday.

But enough about losses…

The energy sector is on a run right now, as oil prices hit a 6-week high.

Technology stocks are also among some of Friday’s winners, with the Nasdaq seeing strong momentum on Friday despite finishing the week at a loss.

Some of the biggest winners in tech this week include:

Nvidia

Amazon

Tesla

Apple

Netflix

Google

339,000 jobs were added in the US for the month, blowing the Dow Jone estimate of 190,000 out of the water.

This marks the 29th straight month of positive job growth.

Share Buybacks

Imagine having a box full of your favorite chocolates.

You want to maximize each piece’s value and make it memorable, don’t you?

So you decide to take some pieces out of the box and eat them.

And as you have fewer chocolates, each remaining piece becomes a delightful treat that satisfies your sweet cravings.

Companies do something similar.

But they have shares of their company instead of chocolates.

When a company buys back its own shares, it takes them out of the market.

Now, you’re probably asking…

Why would companies do something like this?

For two main reasons:

The first reason is to make their shares more valuable for the shareholders who already own them.

Like having fewer chocolates in the box, which makes each chocolate more special.

The second reason is to prevent other people from getting too much control over their company...

Like if you and your friends all have chocolate, but you don’t want one friend to have more chocolate than you.

Now, share buybacks have their pros and cons. Here are:

The 3 sweetest flavors of share buybacks that will lead to impressive gains and lasting wealth:

Sweetening your experience as a shareholder.

Just like biting into delectable chocolate, share buybacks enhance the experience for shareholders.

When a company buys back its own shares, it reduces the number of outstanding shares available in the market.

This reduction increases the ownership stake of existing shareholders, giving them a larger piece of the cake.

As shareholders own a larger percentage, they will enjoy a greater share of the company's future profits and potential growth.

Savoring the sweetness of the company’s value.

Sometimes, the market can undervalue a company's shares, just like overlooking the richness of Ritter Sport's chocolate flavor.

In such cases, companies may choose to engage in share buybacks.

This way, companies show their confidence that the market has underrated the sweetness of their value.

Investors see this as a positive sign, leading to an increase in the share price.

Delighting in improved financial ratios.

Imagine a box of chocolates with beautifully arranged layers.

Similarly, a company's financial ratios reflect its health and attractiveness to investors.

Share buybacks can be like cleaning up and refining those ratios.

When a company repurchases its shares, it reduces the number of shares available in the market.

As a result, the earnings per share (EPS) on the remaining shares increases, creating a more enticing treat for potential investors.

Improved financial ratios make the company more appealing to investors as they check its value and potential for growth.

But when it comes to share buybacks, just like a box of chocolates, there are a few that leave a sour taste in your mouth.

You can avoid those unpleasing pieces of chocolate, but you have to know which ones they are.

So, let’s find out…

The 3 bitter flavors of share buybacks that kill your delightful experience while silently eroding your financial success: