Welcome to The Profit Zone, where 12,000+ millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on Substack, providing you with weekly insights on the stock market and tips you can’t find anywhere else.

If you want the benefits of being a premium subscriber, consider joining on a 14-day free trial.

You can test the waters before making any commitments.

Click below to unlock premium content free of charge for 14 days.

Tweet of the Week

Advertise with The Profit Zone

Do you have a business that needs some more exposure?

Want to get more eyes on your products?

Advertise to 12,000+ investors hungry for financial content.

Click here to fill out the form.

Weekly Market Update 🗒️💡

The S&P 500 climbed by 5.85% this past week.

Leading the charge were the Real Estate and Financials sectors which were both up 9% and 7% respectively.

Although still down YTD as both sectors are impacted heavily on the interest rate environment, it’s good to see investor confidence start to come back in these two dividend-paying sectors.

The Dow was up 5.07% this past week notching its best week since October 2022, while the Nasdaq rose by 6.61%, notching its best week since November 2022.

Investors are now growing more hopeful that the Fed won’t be hiking rates anymore.

Jobs Report

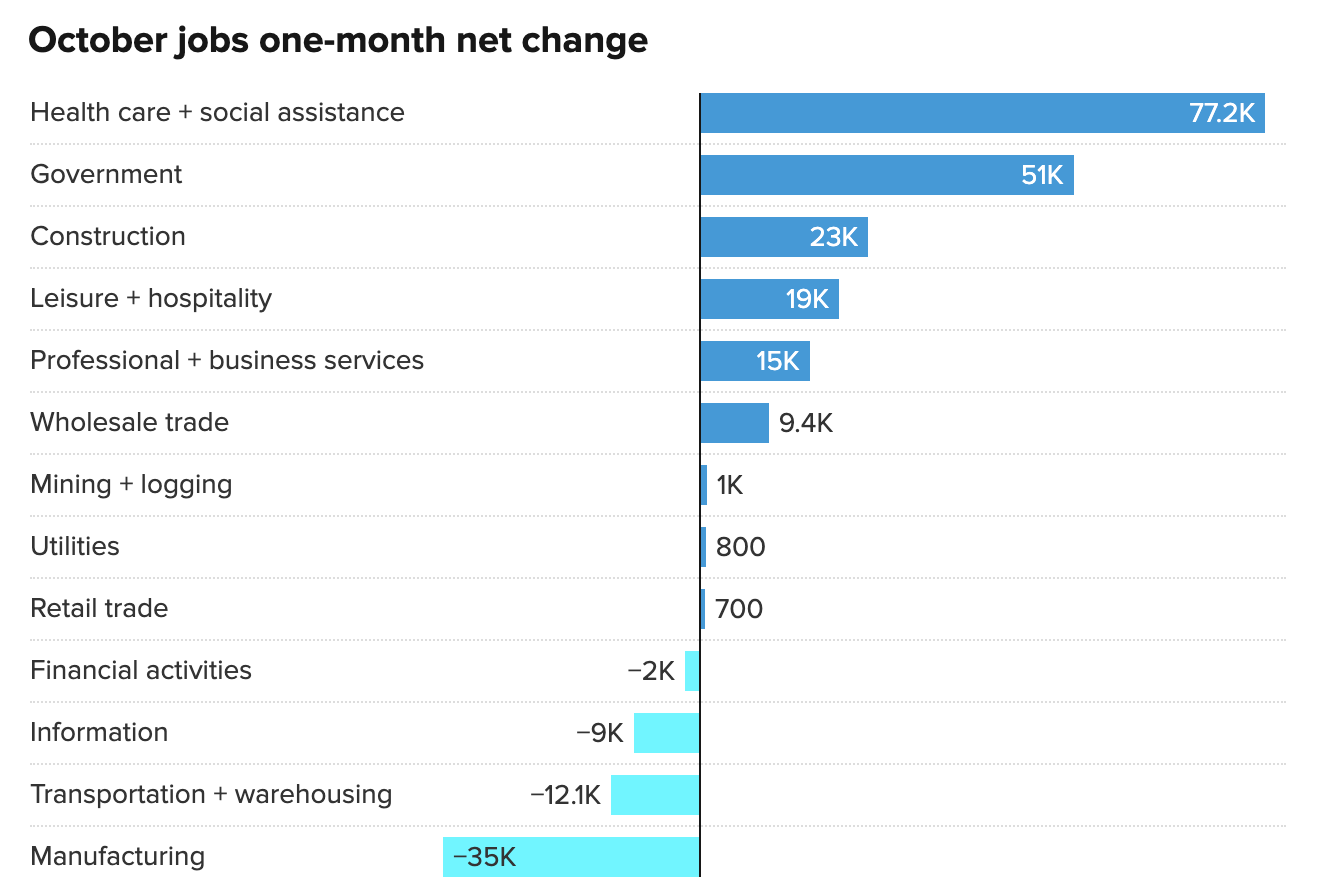

October jobs report numbers are out. Coming in weaker than expected, proving the Fed’s attempt to cool the economy off is working.

The US added 150,000 jobs last month, below the 170,000 estimate from Dow Jones, and much lower than September’s 297,000 jobs added.

Unemployment rose to 3.9%, compared to estimates that it would hold at 3.8%.

Below is a breakdown of the industries seeing the highest increase in jobs added.

The average hourly earnings also fell short of expectations, rising 0.2% in October and below the anticipated 0.3% increase.

Bond yields also tumbled on Friday.

The 10-year Treasury yield lost more than 9 basis points to 4.57%, down from the 5% high it hit last month.

The 2-year Treasury yield lost 13 basis points to 4.8%.

Top 10 myths about saving for retirement

Retirement planning can be a scary journey.

The path to financial freedom often seems clouded by myths and misconceptions.

There are so many out there that many investors find themselves believing.

It's crucial to debunk these myths as you embark on this important endeavor, so you can make better decisions about your financial future.

Now let’s shed light on the truths that will set you on the path to financial freedom:

Myth #1: "I'm too young to start saving for retirement."

The truth is that starting early is the key to financial success in retirement.

The earlier you begin saving, the more time your money has to grow.

Even if you can only save a small amount each month, it will accumulate significantly over time.

Waiting until you're older means you'll need to save much more to reach your retirement goals.

And nobody wants to play catch up.

Also, the best time to start thinking about your financial future is when you’re young, have no family and have minimal expenses.

You want to have a solid foundation when it comes time to support your future kids.

Myth #2: "Social Security will be enough to cover my retirement expenses."

While Social Security is an essential part of many people's retirement income, it's not sufficient on its own.

The average Social Security benefit sits around $1,500 per month, which often falls short of covering basic living expenses, let alone enjoying a comfortable retirement.

It's vital to supplement Social Security with additional savings and passive income generated through years of accumulating cash-flowing assets.

Myth #3: "I need to have a lot of money saved before I can retire."

You don't need to be a millionaire to retire comfortably.

With careful planning and smart financial decisions, you can retire on a more modest budget than you might think.

The key is to create a retirement plan tailored to your unique financial situation.

My retirement number may be different from your retirement number.

It all boils down to:

where you live

who depends on you financially

your income

the assets you own

the lifestyle you lead