VOO vs VTI: What's the better choice?

Welcome to the +31 subscribers who joined this past week and are now part of 6,012 millionaires, CEO’s and high-performing entrepreneurs who read the #1 financial newsletter on Substack.

My name is Alex and I love creating streams of passive income. My goal is to help you do the same.

If you’ve enjoyed The Profit Zone please take 30 seconds out of your day to share this newsletter, leave a like, or a comment. It means the world to me and costs you a total of $0. Thank you for the support! It doesn’t go unnoticed.

Announcement

The Profit Zone just crossed 6,000 subscribers!!! 🎉🎉🎉

When I started The Profit Zone I never would have thought we’d reach 6,000 in less than 9 months. Insane!

I just want to take this time to thank each and every one of you for subscribing and supporting me. I write these newsletters because finance/investing is my passion. I wake up in the morning and I’m excited to bring you guys the best content I can possibly share. To be able to write to 6,000 of you is a dream come true, and I wouldn’t be here without you.

So thank you from the bottom of my heart and cheers to the next milestone!🥂

The S&P Vs. The Entire U.S. Stock Market

If you’re reading this, you probably already have a good idea of what an ETF is. If not, an ETF (Exchange-Traded Fund) is a basket of stocks held within a fund that trades on the stock market. One of my favorite ETF providers is Vanguard, as they offer some of the lowest fees and have a very solid history of performance.

The Vanguard S&P 500 Index ETF (VOO) and The Vanguard Total Stock Market Index ETF (VTI) are 2 of the most popular ETFs among investors, and you’ll see why. Both have performed fairly similarly over the long term and have about an 80% overlap.

In this issue, I’m going to be diving into which one you want to hold and why.

The Total Stock Market 🌎

VTI seeks to provide broader exposure to the entire U.S. market, holding a mixture of mid to small-cap stocks as well as large-caps. The fund holds over 4,000 different companies with the top 10 largest holdings comprising about 25.6% of the fund, as seen below. This fund is absolutely massive and allows you to have your hands in many different buckets at once.

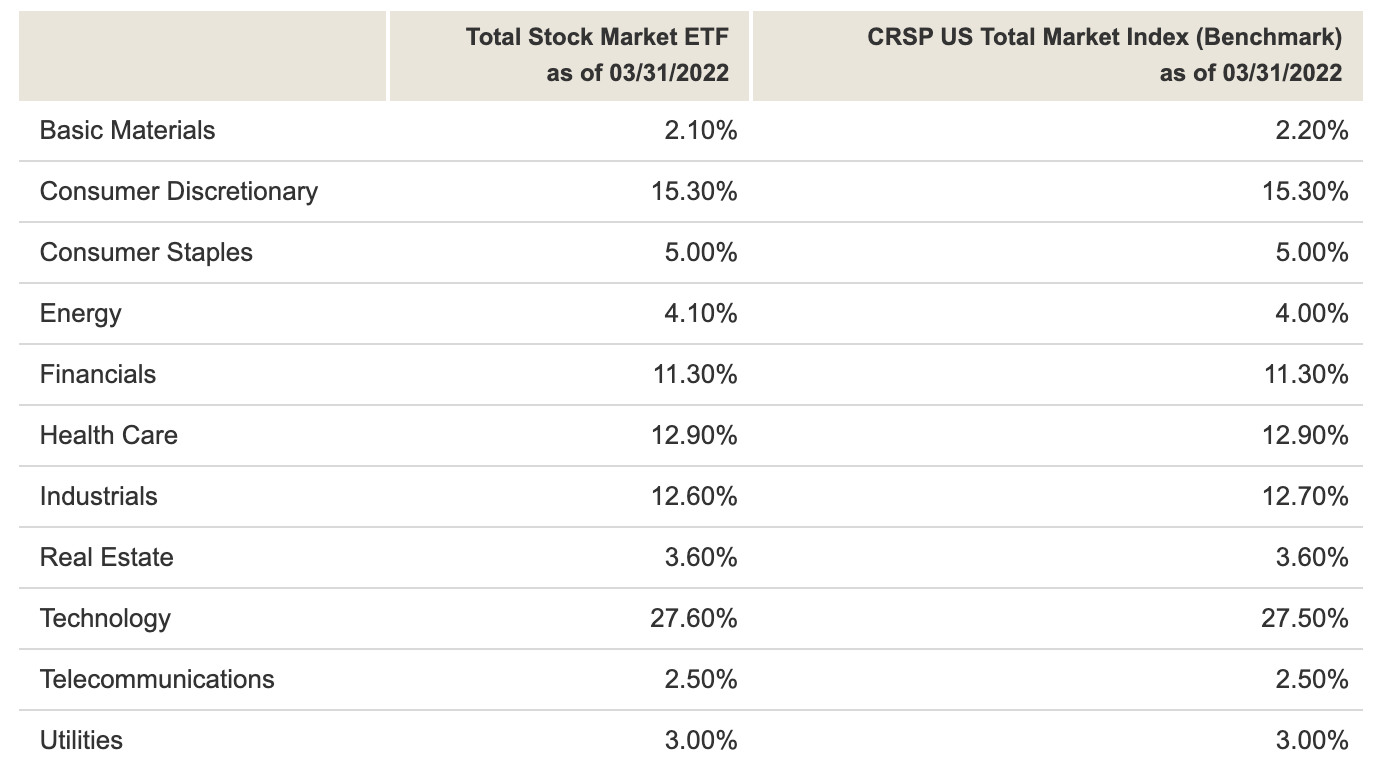

As you can see below, some of the more heavily weighted sectors include Technology, Consumer Discretionary, Health Care, and Industrials.

As for past performance, VTI has returned 8.11% since its inception.

The 500 Largest U.S. Companies 🏛️

Moving onto VOO, this fund seeks to track the 500 largest companies in the U.S. meaning it holds ONLY large-cap businesses. It is a bit more concentrated in its top 10 holdings making up 30.4% of the total fund, which means these companies will have a larger effect on the price movements of the total fund.

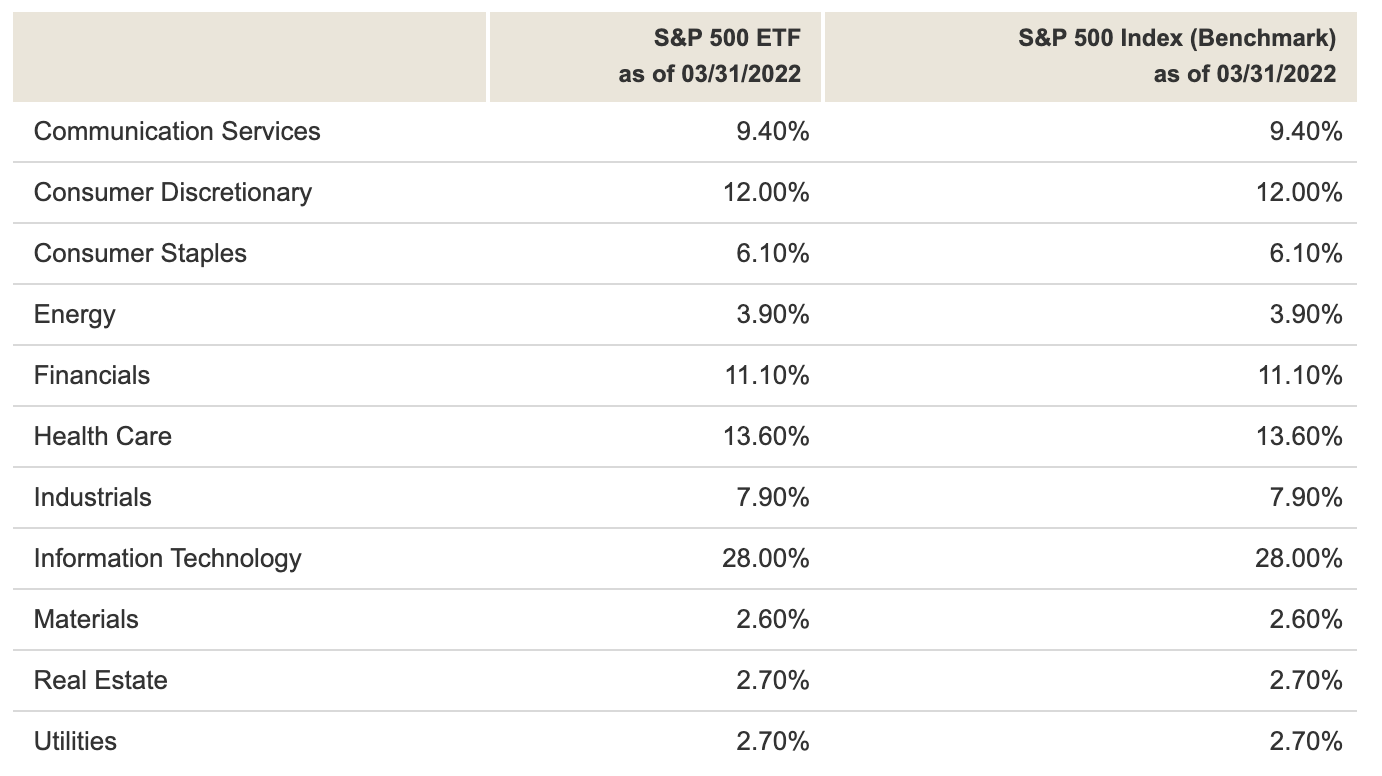

Some of the more heavily weighted sectors are similar to VTI, including Technology, Consumer Discretionary, Health Care, and Financials.

Since its inception, VOO has returned 14.32%, much higher than VTI’s 8.11%.

Which one should you buy? 🤷♂️

There’s no right or wrong answer and here’s my most honest opinion on these 2 funds.

I’m personally a big believer in walking a fine line between diversification and concentration, and I do believe you can be “too diversified” or “too concentrated”. There’s a middle ground that needs to be found.

A common issue I see with new investors is that they want to own every single stock in the market but only have a couple thousands of dollars to invest with. I see a major problem with that because if you own 150 positions with only $2,000, each position will be incredibly small and not allow you to participate in the gains or dividends of the company.

So when it comes to these 2 funds, my preference leans towards the S&P 500. Not because of past performance (although it has performed better) but because I value concentration. I believe in holding quality and a lot of it. I’d rather have 5 slices of the best pies than 50 slices of decent pies. Naturally, those 5 slices will likely be worth more than the 50 slices combined.

This is just my preference and of course, owning the entire stock market is not a bad idea either. You may experience smaller returns as your money is spread across more companies, but with that also comes less volatility. So if you’re a risk-averse investor and just want somewhere to park your money that will generate a decent return without you having to worry about a thing, the total stock market might be for you.

Another argument for owning Vanguard’s Total Stock Market Index ETF (VTI) is that it holds small and mid-cap companies, which can grow faster than a large-cap could, simply because they are a lot smaller and have larger runways. Again, when your money is spread across 4,000+ companies, the effects of this growth will be minimal but if you’re bullish on small and mid-cap businesses in the future then this might be the right choice for you.

Again, there is no right or wrong answer here. There is no better fund. There is only your preference and what suits your investing style. I personally would not own both as there is just too much overlap between the two. VOO is inside VTI, it just also contains 3,500+ other companies as well.

As for expense ratios, they both offer an MER of 0.03% which is absolutely dirt cheap. The only question you need to ask yourself is do you prefer to be more concentrated or not. If you can answer that question, then you can find the right fund.

For my Canadian friends 🇨🇦 (I’d never forget about you)

The Canadian equivalent of these 2 funds are:

VFV - The Vanguard S&P 500 Index ETF

VUN - The Vanguard Total Stock Market Index ETF

Same funds, just in Canadian dollars. Helps you bypass all of those criminal conversion fees. Cheers.