Why QQQ is superior to VGT (Ft. Stephen Wealthy)

Welcome to the +57 subscribers who joined this past week and are now part of 7,159 millionaires, CEO’s and high-performing entrepreneurs who read the #1 financial newsletter on Substack.

If you’re enjoying The Profit Zone, please take a few seconds out of your day to share this newsletter, leave a like, or a comment. It means the world to me and costs you a total of $0. Thank you for the support! It doesn’t go unnoticed.

Tweet of the Week

Today’s Profit Zone is brought to you by Stephen Wealthy (Co-founder of Cash Flow University)

A quick introduction…

My name is Stephen Manning and I’m the co-founder of Cash Flow University, an online community dedicated to helping our members build their passive income and build stable wealth.

I graduated with distinction in 2003 from the Haskayne School of Business at the University of Alberta and I have worked for myself for 15 years after deciding the 9-5 grind was not for me. I am passionate about building multiple streams of income that I own because I believe this is the only way you obtain financial freedom before you are 50 years old.

Follow me on Twitter

Why QQQ is superior to VGT

It is no secret I own 1300 shares of QQQ. I share this on social media every week. Without fail, I always get this question:

“Why not VGT? The fees are lower”

The quick answer is this: “Because the data shows QQQ is better, and VGT has weird exclusions.”

“What’s a weird exclusion?” you ask? Let’s dig in.

First, what is QQQ?

The QQQ or “The Triple Q” is an ETF that tracks the Nasdaq 100 Index.

It is a stock index of the largest 100 non-financial companies on the Nasdaq.

It is the #1 large-cap growth fund for the past 15 years.

Definition out of the way, let’s see why it is superior.

Reason 1: Performance

QQQ has outperformed VGT. In the 17 years since VGT has been around, QQQ has given more returns to its investors.

Also note QQQ in the chart below that it has outperformed the S&P 500 index ETF SPY.

Reason 2: Diversification

While VGT is ONLY tech, QQQ is the top 100 stocks on the Nasdaq. QQQ is not JUST tech stocks Here is the sector breakdown for QQQ

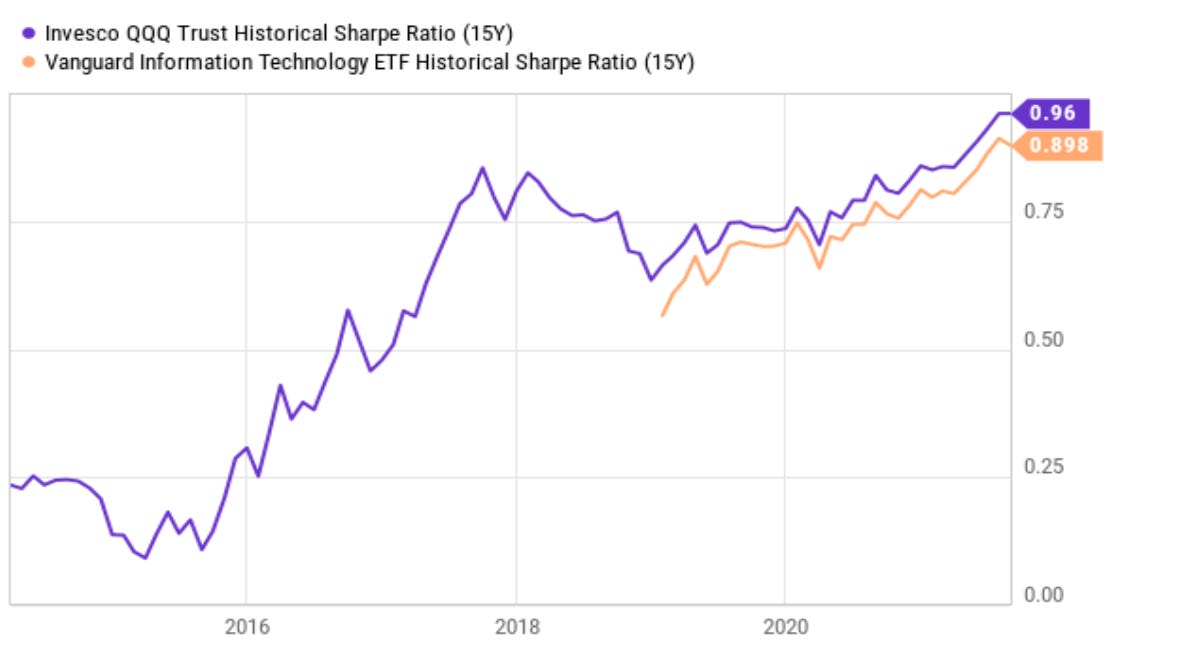

Reason 3: Better risk-adjusted returns

Risk-adjusted returns for QQQ beat VGT. This means for every unit of risk you took on, you were rewarded with more returns.

Here is a chart showing the Sharpe ratio for the two funds over the recent past.

Reason 4: Concentration risk

While VGT holds 361 stocks, Apple AAPL 0.00%↑ and Microsoft MSFT 0.00%↑ account for 37% of the total fund. In comparison, QQQ only holds 100 stocks, but Apple and Microsoft only account for 21%.

This means VGT investors are more susceptible to price fluctuations with these two companies.

Here are the holdings of VGT

Reason 5: Weird Exclusions

VGT does NOT include:

– AMZN

– GOOG

– TSLA

– FB

QQQ does

Do you not think it’s weird for a tech ETF to exclude FB, GOOG, AMZN? These are the giants of social media, search, and cloud computing.

In my own professional career, I’ve helped large organizations offload their on-premise IT infrastructure over onto Amazon AWS cloud infrastructure.

And we don’t need to get into how influential Facebook and Google are with online advertising, search, and social media. Remember, Instagram is a Facebook product.

Reason 6: Size & Volume

QQQ is a beast – $216B market cap

VGT is smaller – $58B

Trading is more active on QQQ, so you will get a good bid price when you sell, even during a crash or panic sale.

Reason 7: Options market

QQQ: 9,400,000 open contracts

VGT: 5,100 open contracts

There is no comparison, NONE. Why is this important?

If you ever want to hedge, lever, or generate additional income, QQQ will do it faster, cheaper, and better than VGT.

Summary:

VGT has a fee of 0.10%

QQQ has a fee of 0.20%

But in all other ways QQQ is far superior to VGT

– Risk

– Performance

– Diversification

– Options market

These make QQQ superior to VGT

Not to mention those weird exclusions! 🙅♂️

A CFU Promo from the Co-Founder Himself

Cash Flow University is an online community that is focused, dedicated, and aligned to help the members build their side hustle income streams. We share, teach and motivate each other to build passive income using 12 methods. Join the community and learn how many are monetizing their social media accounts, renting out their cars, selling call options on stocks, renting out a vacation rental, flipping items on eBay and many more ways.

I’m offering an exclusive discount to Profit Zone members!

Use coupon code PROFITZONE10 and get 10% OFF your first 3 months. Offer is good only until the end of November.

Some resources to help you make more money:

My Full Stock Portfolio - get access to all of my positions and get updates every time I buy or sell.

Money Mastermind - the “Money Bible”. Myself and 29 other expert creators teamed up to create the most all-inclusive 280-page finance book on the market. Over 100 topics about money including real estate, crypto, budgeting, dividend stocks, online business, and more.

The Complete Investors Accelerator Pack - everything you need to build a dividend portfolio that grows on itself. Learn more about dividend investing, how to analyze dividend stocks, what to do with your dividends and how to build a stream of passive income through the stock market.

The Molina Letter - the only product that’s helped me grow my Twitter account to 30,000 followers. Fill in the blank templates you can copy to help you create viral content with minimal effort. A big following gives you the key to creating products and making money online. There’s a reason why 500 people are subscribed to this letter.

TweetHunter - let the software do the tweeting for you. The only scheduler you’ll ever need. This tool makes me money in my sleep. Give it a try for free.

Hipster Budget Guide - having trouble saving money? Learning how to budget is your solution. This book will show you ways to save money you never even thought of. Worth every penny.