How to squeeze more income out of your stocks and lower your cost basis

An effective strategy for creating "passive income" from non-dividend paying stocks

Welcome to The Profit Zone, where 12,500+ millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on Substack.

Teaching you what schools forgot in 5 minutes or less.

Happy Monday!

Let’s start the week off strong.

The agenda for today:

👉 S&P 500: the rally continues, will it ever stop?

👉 CEOs: the great share dump

👉 Covered calls: squeezing more income out of your stocks and lowering your cost basis

Tweet of the Week

Quote of the Week

A budget tells us what we can't afford, but it doesn't keep us from buying it.

- William Feather

Weekly Market Update 🗒️💡

Indexes

All three major averages captured winning weeks.

S&P 500: up 1.66%

Nasdaq gained: up 1.4%

Dow: up 1.3%

Nvidia

The tech beast continues to rally.

The leading chipmaker surpassed a $2 trillion valuation briefly this past week after posting strong quarterly results.

Earnings per share: $5.16 adjusted vs. $4.64 expected

Revenue: $22.10 billion vs. $20.62 billion expected

Will the run continue or are we in a tech bubble that is approaching a POP?

CEOs continue to cash in their shares

Well known CEO’s and multi billionaires continue to dump their shares.

Between them, these 3 moguls have sold $9.3 billion of stock in less than a month.

From a money perspective, It makes sense even for billionaires to diversify out of having the overwhelming majority of their wealth in a single stock.

Dimon sold $150 million of JPMorgan shares on Feb. 22.

Zuckerberg sold $661 million of Meta shares between Jan. 31 and Feb. 21.

Bezos sold $8.5 billion of Amazon shares between Feb. 9 and Feb. 20.

Although this may seem like a massive sell off, it doesn’t compare to the $39.5 billion of Tesla shares Elon Musk sold between November 2021 and December 2022, needed to buy Twitter (X).

How to squeeze more income out of your dividend stocks and lower your cost basis

Did you know that there is a way to generate extra income on the dividend stocks you already own?

You can also turn non-dividend stocks into “dividend stocks” that pay you passive income.

Let me explain…

There is an option strategy called Covered Calls which is used to generate income in the form of options premiums.

You can use this strategy if you expect a minor increase or decrease in the stock price.

Essentially, if you believe that the stock price won’t change much in the short term, covered calls might be an effective way to squeeze out some more income.

To execute this strategy, you must hold 100 shares on the underlying assets (1 contract) and then write (sells) a call option on that same asset.

If you’re wondering if this strategy works without holding 100 shares of the underlying asset, it does…

But that is called a Naked Call and I would advise against it as you would theoretically have unlimited loss potential if the underlying asset rises in price.

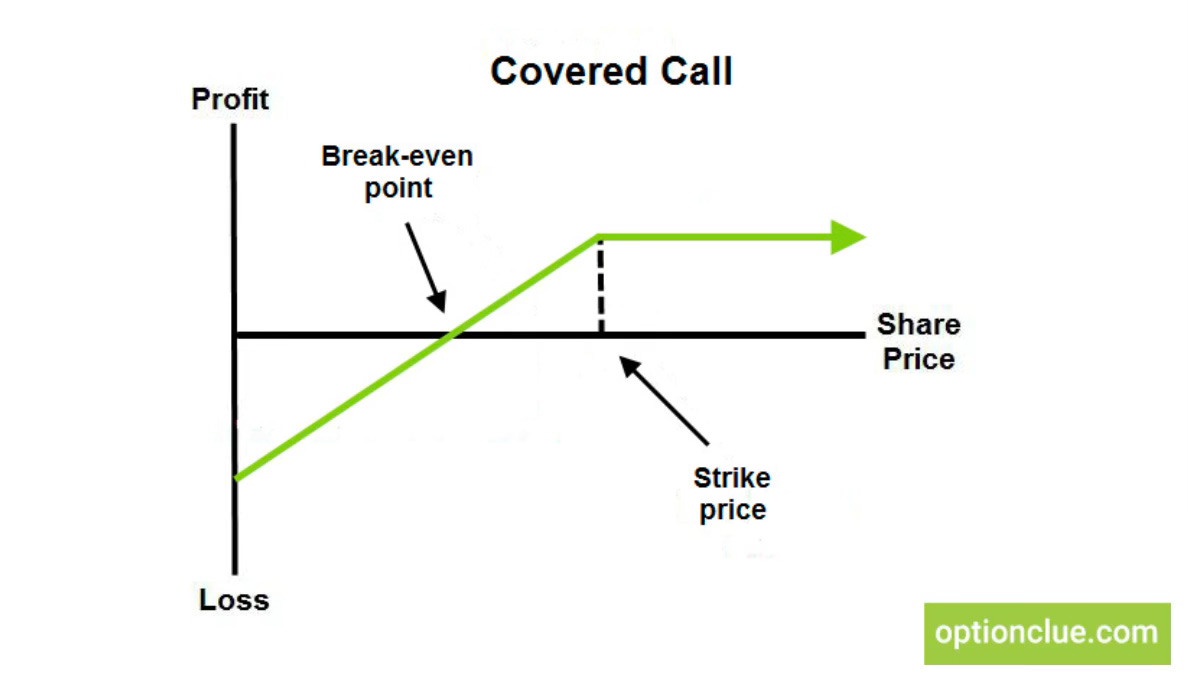

Below is a diagram showing how a covered call works.

The maximum profit you can earn on a covered call is equal to the premium received for writing the call and the upside of the stock between the current price and strike price chosen.

Selling a covered calls limits the profit you can earn but does not eliminate downside risk.

With being said, it does help to reduce the risk by the price of the premium received, which lowers your cost basis.

Example:

Let’s say you buy 100 shares of Stock ABC at $100 and you sell a call option at a $105 strike price for $5.

The cost basis is reduced by $5 (money that is now in your pocket) meaning your break even point of the long stock position is now $95.

Initial money spent: $10,000

Premium received: $5 x 100 shares = $500

Average cost: $10,000 - $500 = $9,500 ($95/share)

Scenario 1: Stock ABC trades BELOW the $105 strike price

The option will expire worthless and you get to keep the premium of $500 for writing the call option. You still own the stock and have some extra cash in your pocket with a lower cost basis of $95. This is the optimal scenario.

Scenario 2: Stock ABC trades ABOVE the $105 strike price

The option is exercised and the upside in the stock is capped at $105. You sell your shares at $105, keep the premium of $500 and the price appreciation of your shares from $100 to $105 ($5 x 100 = $500).

Total return is $1,000 ($500 premium + $500 in share appreciation).

*Your ad could be here*

Want to get more eyes on your products?

Advertise to 12,500+ investors who are hungry for financial content.

Click here to book with us.

Are covered calls profitable?

Yes and no.

The highest payoff from a covered call happens when the stock price rises to the strike price and goes no higher. In this case, your shares aren’t “called away” and you get to keep the premium as the option expires worthless.

Are covered calls risky?

Yes.

However considered relatively low risk, covered calls limit how much you would earn in upside potential should the stock continue to rise.

They also do not protect you in the event that the share price begins to drop, however you would keep your premium and your average cost would fall by that same amount.

So there is some downside protection involved as well.

Loss of upside

This strategy isn’t effective for investors who are very bullish or very bearish on an asset.

Bullish investors are better off just holding the stock instead of writing call options because the option caps the profit on the stock at the strike price which could reduce the profit should the asset continue to rise in price.

How to maximize your profit when writing covered calls

There are many different factors to consider when selling a covered call.

Strike prices chosen closer to the stocks current price will receive a higher premium but come with a higher probability of being “called away” at expiration.

Calls with longer days to expiration also offer higher premiums, but leaves more time for the stock price to rise above your strike price.

These are all things you have to consider when writing a covered call.

Rule of thumb:

Refrain from trading options near earnings releases.

The reason is simple: stock prices are naturally more volatile during earnings and a spike in price could have a negative impact on the profitability of your call option.

I’ve got something for you…

Financial freedom doesn’t just happen by chance.

It’s the result of continuously doing the small things right every single day.

The problem is, there’s so much information out there that most people don’t even know where to start.

So I did something about it.

Financial Domination is the ebook you didn’t know you needed.

Everything you need to know about becoming the CFO of your own finances, in one place.

I’ve studied the market for 8+ years so you don’t have to.

Click here to get your copy and live a life people dream of.

See you in the next one!

Alex (The Dividend Dominator)

Founder and CEO of Dividend Domination Inc.

Follow me on Twitter, Instagram and LinkedIn

Some resources to help you make more money:

My Website - a one-stop shop for all things dividend investing.

Financial Domination - learn how to set up an effective budget, choose the right broker, figure out your investing strategy, use stock screeners to filter out the garbage and more. Everything I wish I knew when I first started investing.

The Complete Investors Accelerator Pack - everything you need to build a dividend portfolio that grows on itself. Learn more about dividend investing, how to analyze dividend stocks, what to do with your dividends and how to build a stream of passive income through the stock market.

Ca$hing in on Twitter - start building a following on Twitter and learn how to monetize it. Turn Twitter into your own personal cash-flowing asset that will pay you while you sleep.

My Full Stock Portfolio - get access to all of my positions and get updates every time I buy or sell.

Money Mastermind - the “Money Bible”. Myself and 29 other expert creators teamed up to create the most all-inclusive 280-page finance book on the market. Over 100 topics about money including real estate, crypto, budgeting, dividend stocks, online business, and more.

TweetHunter - let the software do the tweeting for you. The only scheduler you’ll ever need. This tool makes me money in my sleep. Give it a try for free.

Hipster Budget Guide - having trouble saving money? Learning how to budget is your solution. This book will show you ways to save money you never even thought of. Worth every penny.

Good post. Did you see Walmart kids dumped like $4B? https://www.arkansasonline.com/news/2021/jul/02/3-walton-heirs-sell-4b-in-shares/