ETFs Made Easy: Selecting the Perfect Fund for Your Portfolio

Streamline Your Investment Strategy with Expert Tips and Proven Methods

Welcome to The Profit Zone, where 12,500+ millionaires, CEO’s and high-performing entrepreneurs read the #1 financial newsletter on Substack.

Teaching you what schools forgot in 5 minutes or less.

Happy Monday!

Let’s start the week off strong.

The agenda for today:

👉 Nasdaq: breaks 2021 records

👉 March: not a good month for stocks?

👉 What is an ETF: the definition of an ETF (in grade 5 language)

👉 How to Pick ETFs: what to look out for when adding ETFs to your portfolio

Tweet of the Week

Setting small milestones along your dividend investing journey helps keep you on track and motivated.

Quote of the Week

As sure as the spring will follow the winter, prosperity and economic growth will follow recession.

- Bo Bennett

Weekly Market Update 🗒️💡

Indexes

The Nasdaq rose 1.74%, hitting an all-time high on Friday and breaking its 2021 record.

The S&P 500 rose 0.95% this past week and also hit a record close on Thursday.

The Dow Jones was the only loser for the week, falling 0.11%.

What we’re seeing is a massive run up in tech because there’s a belief of what it “could be”.

The AI boom is no joke, but it has people disregarding the rest of the market.

My Take: buy the stocks/sectors that nobody is talking about. That’s where the opportunity is.

The Market - 1 week performance

March: not a good month for stocks?

LPL Financial chief technical strategist Adam Turnquist mentions that March has historically been a good month for stocks. The S&P 500 has posted an average return of 1.1% in the month of March however during election years, the average return in March falls to just 0.4% with notable weakness in the middle of the month.

Use this information as you wish.

Ray Dalio on “The Bubble”

Billionaire investor Ray Dalio believes the U.S. stock market is not in a “bubble”.

He analyzed his bubble criteria, including valuation, sentiments, new buyers and unsustainable conditions and mentions that using that information, the market doesn’t look very “bubbly”, to him at least.

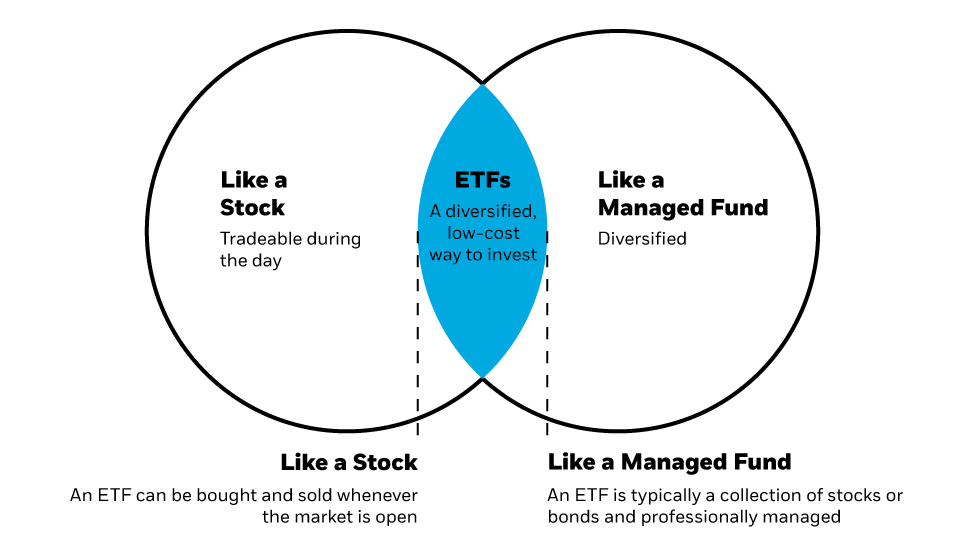

What is an ETF?

Before outlining how to pick an ETF, it’s important to identify what an ETF actually is.

An ETF (Exchange Traded Fund) is a pooled investment security that can be bought and sold like an individual stock.

Think of it like buying a salad.

When you buy a salad, you aren’t just getting the salad.

You’re getting everything that comes inside that salad.

The croutons, the tomatoes, the onions, the cucumbers, the sauce and anything else you might want to throw in there.

An ETF can be structured to track anything from the price a commodity to a large and diverse group of assets.

There are ETFs that are even designed to track a specific investment strategy.

Some examples of ETFs you can buy:

Equity ETFs

Bond/Fixed Income ETFs

Commodity ETFs

Currency ETFs

Specialty ETFs

Sustainable ETFs

Real Estate ETFs

Have you ever heard someone say: “There’s an app for that!”

Much like apps, there’s probably an ETF for whatever you’re looking for.

How to Pick ETFs

The first step to picking ETFs is understanding your investor profile.

Typical considerations include:

Your age

Your investing knowledge/experience

Your time horizon

Your risk tolerance

Understanding if you’re a conservative, moderate, or growth-oriented investor plays an important role in choosing the right ETF for your portfolio.

Additionally, your age and time horizon will determine what type of holdings you’ll want to own inside your portfolio.

Figure out who you are as an investor before you start making any type of investments.

Here’s what you should be considering when buying ETFs:

Fund Size

ETFs with a low level of assets under management (AUM) can be subject to lower liquidity levels and wider trading spreads.

When I’m looking for an ETF to add to my portfolio, I like to buy ones that have sizeable assets under management to minimize the risk of a future closure and protect me against large amounts of volatility.

Tracking Difference

You would think that if an ETF tracks an index that rises by 10%, the value of your ETF will rise by the same amount.

WRONG.

Tracking difference is the difference between the ETFs performance and that of the index.

Because ETFs are subject to a number of costs, including transaction fees, regulatory and operational costs and Management Expense Ratio’s (MERs), the small difference can become significant over a long period of time, cutting into your profits.

Performance

Past performance never guarantees future returns, but as an investor you should be analyzing the ETFs performance over various timeframes and compare it with its benchmark index and other similar ETFs.

Passively or Actively Managed

A passively managed ETF will typically have lower fees than its actively managed counterpart. Understanding what type of ETF you’re buying is key to understanding the fees and costs that come with it.

Physical or Synthetic?

Physical ETFs invest in the underlying asset of the index and are most common.

Synthetic ETFs do not invest in assets directly but rather track the index through derivatives. These are contracts that are tied to the value/price of the underlying asset.

The Largest ETFs Providers

Unlike buying small cap stocks that may have a high upside potential, when buying ETFs it’s usually a good strategy to stick with the Big Boys.

Like a bank loaning money to a developer to build a residential condo, your risk is minimized when you’re dealing with a developer who has successfully completed other projects and has experience doing so.

The 3 largest ETF providers (in order) by AUM are:

BlackRock

Vanguard

State street

#1 Mistake When Buying ETFs

Overlap is a big mistake, especially among new investors, when buying ETFs.

Make sure you know and understand the holdings of your ETF.

Some hold thousands of stocks and some overlap is completely fine, however holding two of the same ETF in your portfolio with similar weightings of similar stocks is overkill and I’d advise against it.

Two Resources to Check Out:

ETF.com is a great website for finding and analyzing ETFs.

It will tell you the ETFs performance, it’s AUM, Management Expense Ratio’s, how many holdings are in the fund, it’s date of inception and you can even compare the performance against other similar ETFs.

I use this website religiously when picking ETFs for my portfolio.

Past Posts in The Profit Zone on ETFs:

See you in the next one!

Alex (The Dividend Dominator)

Founder and CEO of Dividend Domination Inc.

Follow me on Twitter, Instagram and LinkedIn

Sponsor The Profit Zone

Want to get more eyes on your products?

Advertise to 12,500+ investors who are hungry for financial content.

Click here to book with us.

Some resources to help you make more money:

My Website - a one-stop shop for all things dividend investing.

Financial Domination - learn how to set up an effective budget, choose the right broker, figure out your investing strategy, use stock screeners to filter out the garbage and more. Everything I wish I knew when I first started investing.

The Complete Investors Accelerator Pack - everything you need to build a dividend portfolio that grows on itself. Learn more about dividend investing, how to analyze dividend stocks, what to do with your dividends and how to build a stream of passive income through the stock market.

Ca$hing in on Twitter - start building a following on Twitter and learn how to monetize it. Turn Twitter into your own personal cash-flowing asset that will pay you while you sleep.

My Full Stock Portfolio - get access to all of my positions and get updates every time I buy or sell.

Money Mastermind - the “Money Bible”. Myself and 29 other expert creators teamed up to create the most all-inclusive 280-page finance book on the market. Over 100 topics about money including real estate, crypto, budgeting, dividend stocks, online business, and more.

TweetHunter - let the software do the tweeting for you. The only scheduler you’ll ever need. This tool makes me money in my sleep. Give it a try for free.

Hipster Budget Guide - having trouble saving money? Learning how to budget is your solution. This book will show you ways to save money you never even thought of. Worth every penny.

Airship AI Holdings Inc (AISP-$1,68) signs a deal today with the DOJ to supply the Government with AI - the same start up that has failed at other technologies, that has $2 million in revenue and has a CEO, Victor Huang, who is a Chinese National ………. Am I Missing Something?